Short-term or long-term — which approach is best for you? Learn the different approaches to calculating the short-term and long-term portion of your lease liability – it’s as easy as 1, 2, or 3.

Under ASC 842, a lessee is required to present lease liabilities for all leases in a similar manner, however, calculation of the short-term and long-term portion of the lease liability will differ based on the chosen approach.

Key Takeaways:

- ASC 842 requires lessees to present lease liabilities in a similar manner to one another

- There are three approaches to calculating the short-term and long-term portion of the lease liability: summing the principal over the upcoming 12 months, using the effective interest rate to separately calculate the present value of the lease liability, and summing the undiscounted payments due in the upcoming 12 months

- Netgain has chosen to use Approach #1, summing the principal over the upcoming 12 months, as it most closely resembles the guidance for the presentation of the current portion of long-term debt

The three approaches

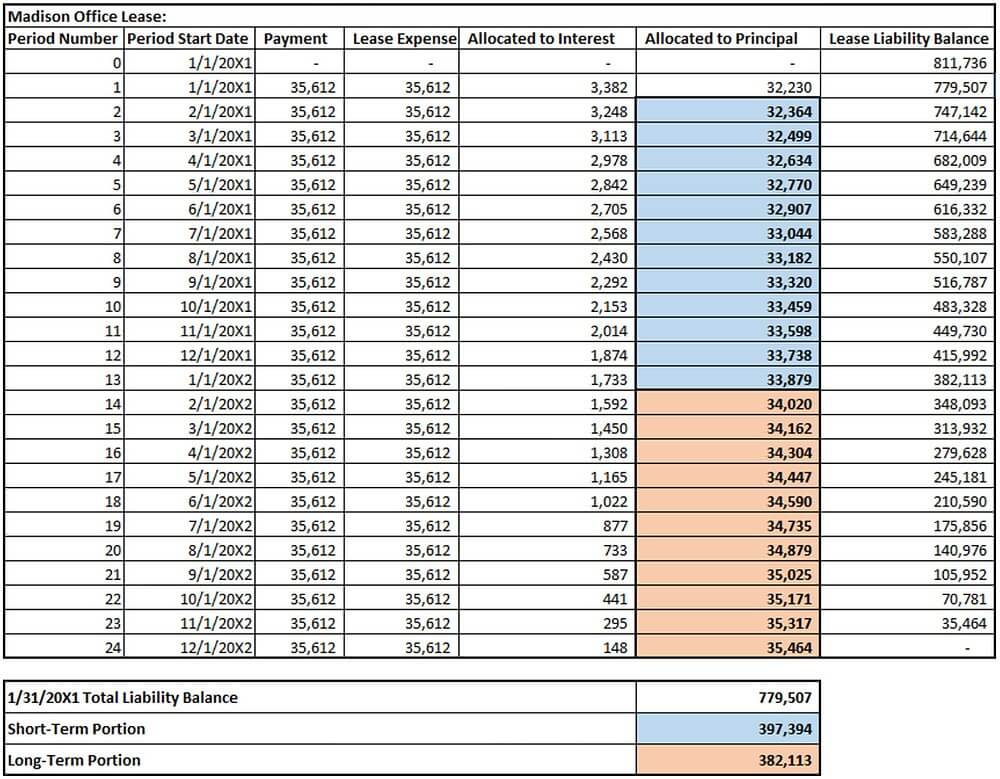

Approach #1:

Calculate the short-term portion of the lease liability by summing the principal to be paid over the upcoming 12 months. The remaining amount is the long-term portion of the liability.

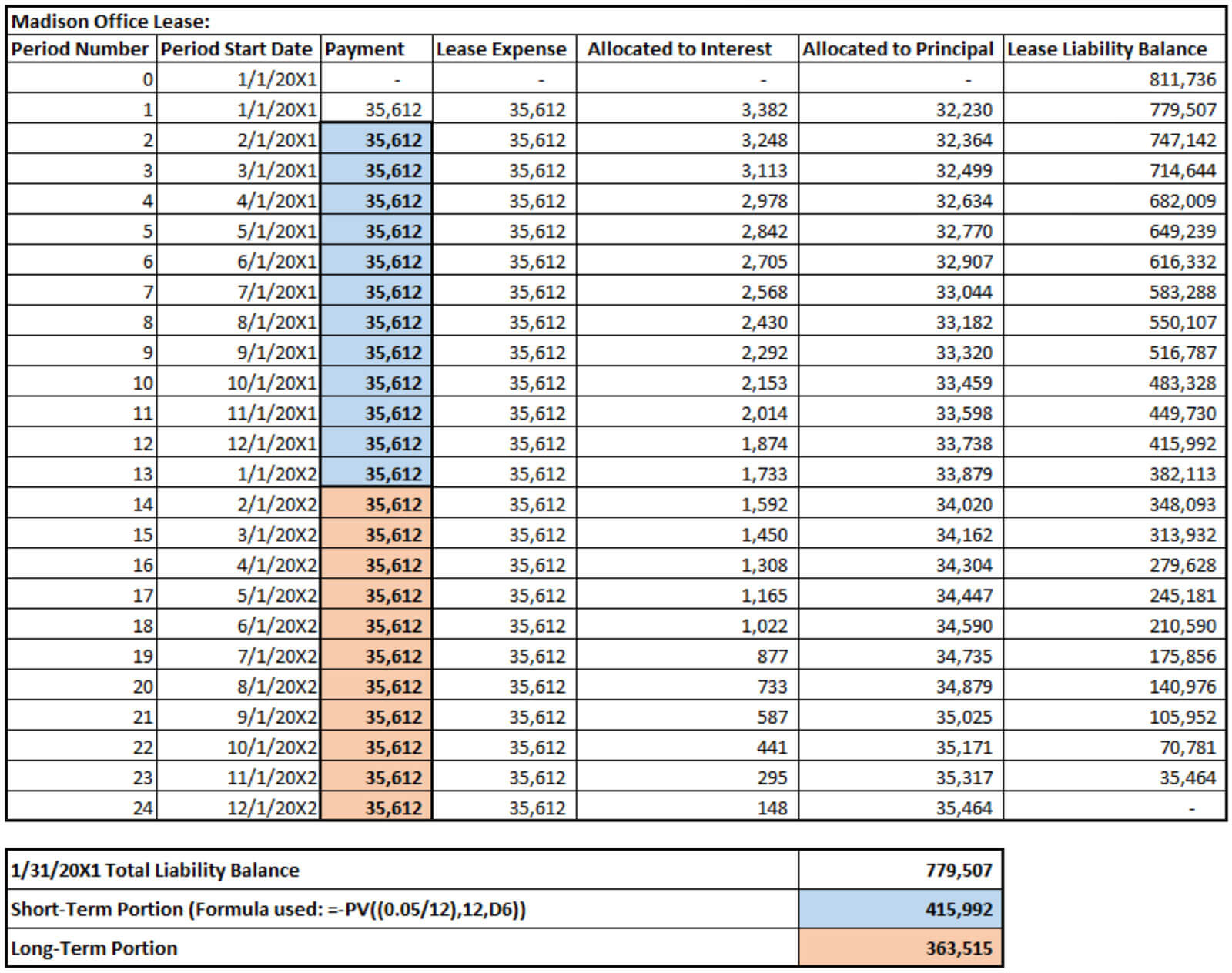

Approach #2:

For all future payments, use the lease liability’s effective interest rate to separately calculate the present value of the lease liability as the long-term portion, and for the short-term portion calculate the present value of the upcoming 12-month payments.

Note: Rate used for the Present Value calculations = 5%

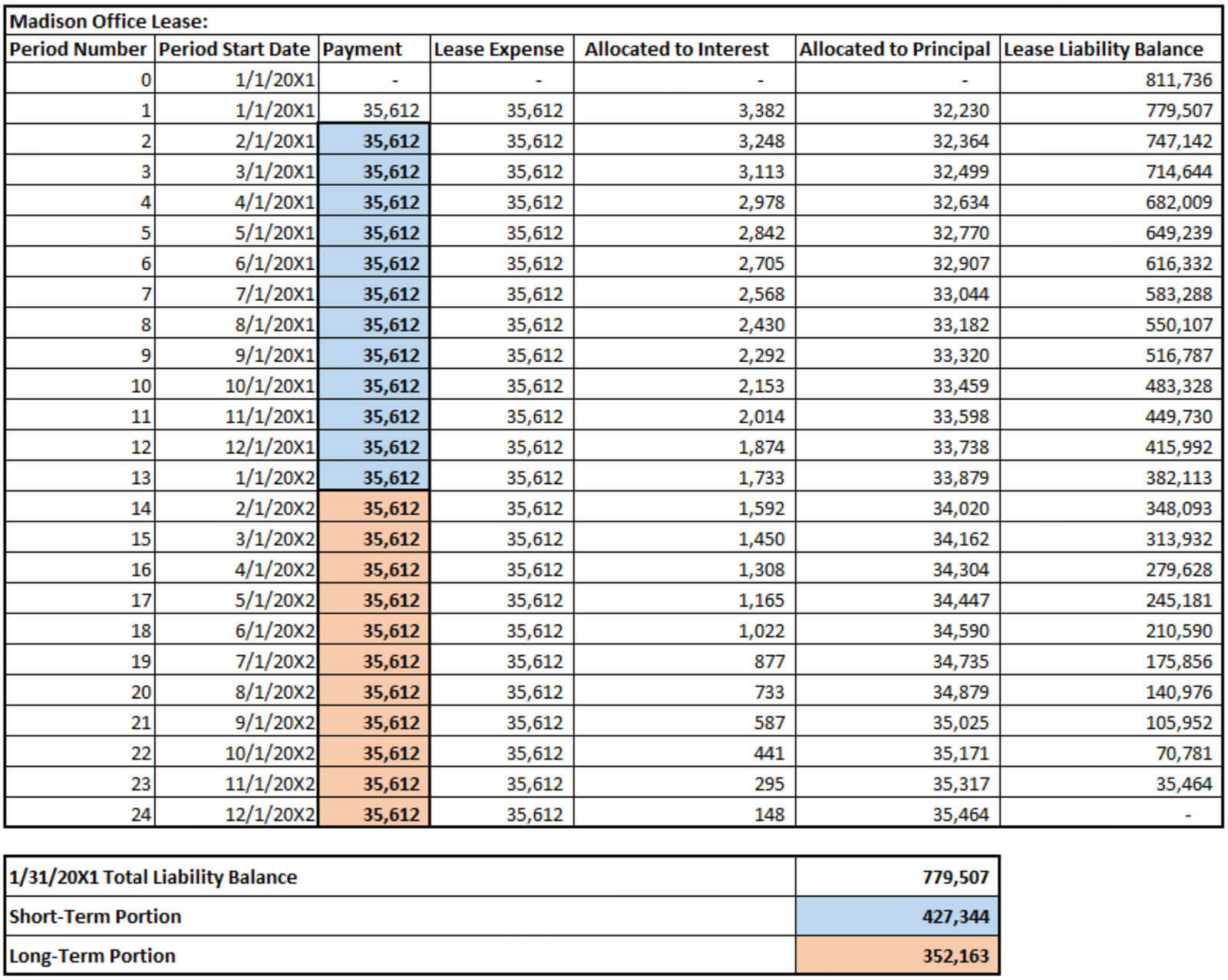

Approach #3:

Calculate the short-term portion of the lease liability by summing the undiscounted payments that are due in the upcoming 12 months. The remaining amount is the long-term portion of the liability.

So, what’s it going to be – 1, 2, or 3?

Here at Netgain, we have chosen to use approach #1 as it most closely resembles the guidance for the presentation of the current portion of long-term debt. The guidance states that the current portion of long-term debt is the amount of principal that will be paid over the upcoming 12 months. As such, Netgain has chosen to treat the lease liability like a loan by reclassifying the upcoming 12-month principal payments as the short-term portion of the lease liability.

FAQs

How do companies calculate the present value of a lease liability?

The present value of the minimum lease payment is simply the sum of all of the lease payments that are to be made in the future, in today’s dollar terms, added to the value of the estimated value of the leased asset once the lease is over.

The reason the payments and residual amount are divided by 1 plus the interest rate adjusted for time is to bring the terms into today’s dollars. To adjust for the timing of the payments and residual amount, you must power the term (1+r) to the value of the period in which the payment and/or the residual amount occurs.

What is the discount rate?

A lease accounting discount rate is a measure of the lessee’s lease liabilities under the new lease standard ASC 842 and a pivotal part of overall lease accounting compliance.

With the new lease accounting standards, lessees have to report all their operating and capital leases with contracts lasting longer than 12 months. Therefore, these contracts fall into the category of lease accounting discount rate

What are the criteria for an operating lease?

An operating lease is a lease agreement in which the lessor (owner of the asset) allows the lessee (user of the asset) to use the asset for a specified period of time, usually in exchange for periodic payments. The criteria for an operating lease are that the lease term must be shorter than the economic life of the asset, the lessee must not assume ownership of the asset at the end of the lease, and the asset must be returned to the lessor in good condition.

What are Initial Direct Costs and how are they accounted for?

Initial Direct Costs associated with a lease must be included in the amount of the ROU asset. An Initial Direct Cost is defined as an incremental cost that would not have been incurred if the lease had not been executed (e.g., commissions, payments made to an existing tenant to incentivize that tenant to terminate its lease, legal fees paid in order to obtain the lease, etc.).

How do I determine the discount rate?

Things may become complicated at this point! Lessees should use the implicit rate in the lease contract (if known) or the business's incremental borrowing rate to calculate the PV. This interest rate is based on the rate that the business would get if it borrowed money to finance 100% of the underlying asset on comparable terms and used the asset as collateral.

Private enterprises have the option to employ the risk-free rate, despite the fact that this can be difficult to determine frequently (e.g., Treasury bill). The downside to this is that it frequently leads to a greater PV, which necessitates the booking of larger corresponding assets and liabilities.

How will operating leases now “look” on the balance sheet?

With ASC 842, operating leases take on a completely new face since a right-of-use (ROU) asset and liability are documented by figuring out the present value (PV) of the lease payments using the proper discount rate.

A ROU asset's classification on the balance sheet is as a long-term asset on a different line item outside of PP&E. Aside from funded debt, the ROU leasing obligation also needs to be divided into short-term and long-term obligations. A ROU asset's profit and loss components are amortized using the straight-line technique and shown as a single rent or lease expense.

EBITDA remains the same as it was when operating leases were accounted for in accordance with the previous lease standards because neither the amortization of the ROU obligation nor the ROU asset is included as an expense for interest or depreciation under ASC 842.