Accounting—even with modern-day software, even in 2022—is hard work. If you work in accounting, you know that publishing financial statements often requires a hodgepodge of different tools trying to glue together different lines of financial statements.

I’ve worked in many areas of accounting including corporate accounting, audits for Fortune 500 companies, IPOs, and everyone’s favorite: internal controls. During that time, I saw firsthand how painful it can be, as a company, to publish quality financial statements without accounting-focused software and adequate resources. Because creating financial statements is so often a catastrophe, I’ve had the desire to help create and implement holistic accounting systems rather than trying to glue all the pieces together. Now, I specialize in working with apps that have an accounting focus and can handle technical transactions for companies crying for solutions.

Even though I trust systems far more than I trust humans, I have channeled my inner auditor to create a downloadable excel template organized like an audit work paper.

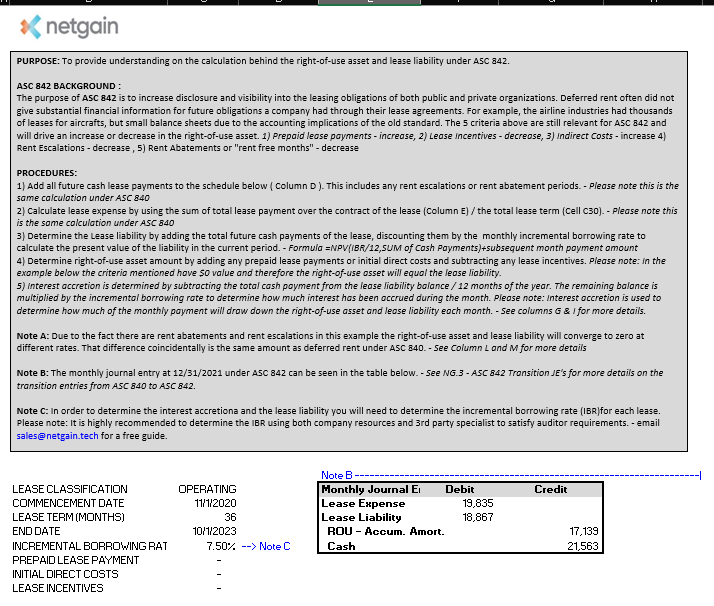

The guide is to help my fellow accountants understand the following steps for a smooth transition:

- Formula driven calculations for both ASC 840 and ASC 842- See second and third tab

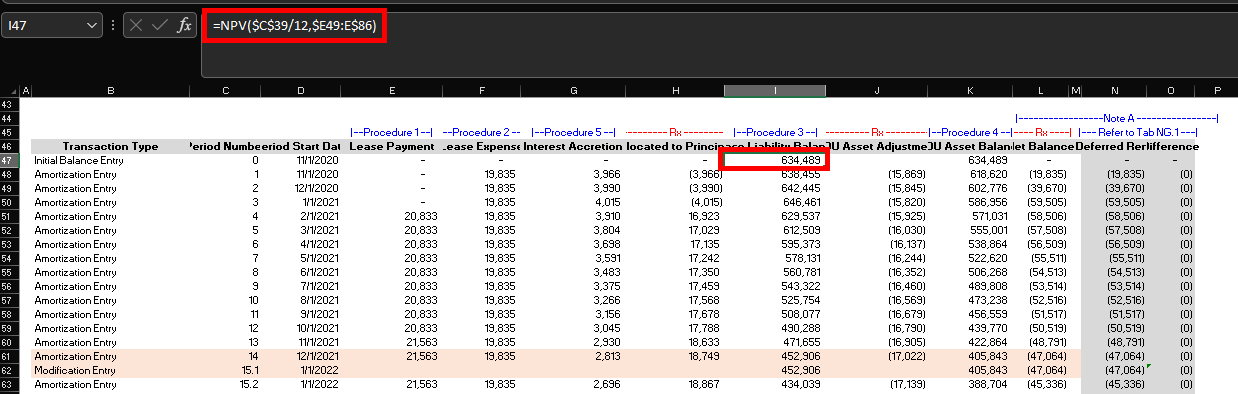

- Step by step procedures to help you navigate calculations and transition steps – See third tab

- Day 1 journals entries for your company to make the transition during in 2022 – see fourth tab

You'll see that I've set up this document to perform and show calculations in a certain way. To better understand that process, take a look at this earlier blog post on setting up amortization schedules in excel.

This template takes into consideration some simple details that are needed to do the calculations properly. Be aware that more complicated leases require more complicated excel sheets. If you need help with them, feel free to contact me via this form

Here's that excel template again:

My take on the “why” we are switching to ASC 842:

In my opinion, ASC 840 was a little misleading when looking at assets and obligations on a balance sheet. ASC 840 accounting would be better described as the deficit or surplus of your total cash payments in comparison to your lease expense over a period of time. In no way did ASC 840 show you current and long-term obligations on a balance sheet.

FASB probably understood this and proposed we switch the accounting to what we now know as ASC 842. ASC 842 gives understanding through increased disclosures and visibility into the leasing obligations of both public and private organizations. Deferred rent often did not give substantial financial information for future obligations a company had through their lease agreements.

For example, the airline industries had thousands of leases for aircraft, but small balance sheets since they were only required to show the deficit or surplus of your cash payments in comparison to your lease expense.

So, now that we have this new standard, how in the world do we transition? And how do we get rid of balance items such as deferred rent?

How to transition to ASC 842

The transition to ASC 842 does not need to be all that complicated...but it can be. When adopting the new standard, lessees are required to apply a one-time modified retrospective approach.

Don't be put off by the ominous wording! Fortunately, the standards boards have provided several practical expedients you can elect to make the transition less confusing. For example, you can elect NOT to adjust comparative periods in your comparative financial statements, allowing you to present old and new side by side. Additionally, you can elect to use hindsight to determine lease terms, not revisit classification or direct costs determinations, and whether contracts contain a lease.

The excel document demonstrates how to transition a lease from ASC 840 to ASC 842 with a commencement date as of 11/1/2020. That said, the example will show the balances retrospectively for the amortization calculations as of the commencement date but will actually transition to the standard in 2022.

If you haven’t fallen asleep (congrats!), you may have a few things going through your mind. What if I was on cash basis accounting? What if the idiot in this position before me didn’t do the ASC 840 schedules correctly?

DO NOT WORRY! The FASB has made it slightly easier to transition and you can take advantage of the practical expedients at the transition date.

In layman’s terms, if you take your current deferred rent on a lease (if any) and plug it into the lease amortization model, you’ll be able to start your amortization schedule as of 1/1/2022. It is much easier than entering in a hairy, multi-contract lease that has been around since long before you worked with your company.

Warning: Excel is not the best solution

I'm very proud of this workbook and you can rest assured that it has the correct accounting, but I would never recommend trying to manage a large number of leases with excel. Although excel is one of my favorite accounting tools to do quick number crunching, it also presents an enormous risk.

System-related journal entries and well-thought-through processes are the best way to perform any type of accounting.

This workbook covers the basics, but these lease examples can get even more complicated depending on how they were accounted for prior to the transition. Complexity grows if you've had any past amendments, rent abatements, rent escalations, prepaid lease payments, lease incentives and other factors. Although I am an expert in the space, not many have as much time as I did to learn the ins and outs of each situation. Here's my advice: get help.

Bottom Line

Use this excel template to understand how the accounting works from an ASC 840 prospective to ASC 842. Keep in mind that this is just the first step towards compliance with the new guidance and the easier, more foolproof solution is switching to a specialized software solution like NetLease.