As the ASC 842 transition deadline fast approaches, companies are devoting considerable resources to streamlining their lease process in order to be GAAP compliant. After spending a significant amount of time to finally determine the classification of your company’s operating leases, it’s finally time to make it official and begin recording the respective journal entries. For more information about the differences between operating and finance leases under ASC 842, you can read Adam Riches’ article.

Key takeaways

- As a lessor, it can be daunting to start generating journal entries for your operating leases post-transition.

- Lessors will not need to substantially change their process when transitioning their operating leases over to ASC 842 from ASC 840

- Netgain’s suite of applications, including NetLessor, allow lessors to automate the accounting for any type of lease.

At this point, you might be thinking this means you’re out of the frying pan and into the fire. As a lessor, it may seem that most resources are directed toward the lessee rather than the lessor. Luckily, I have not forgotten about you! I’ve compiled this helpful guide for lessors that will walk you through the following areas to start effectively and accurately recording journal entries for your operating leases:

- Changes the adoption of ASC 842 will make to the lessor’s accounting treatment of operating leases compared to ASC 840

- The journal entries to be booked by the lessor for an operating lease under ASC 842

- The balance sheet and income statement impact of the recorded entries to the lessor’s financial statements

Changes under ASC 842

Fortunately, if you are a lessor who is engaged primarily in operating leases, the transition from ASC 840 to ASC 842 is very straightforward. Fundamentally, the lessor’s accounting treatment of an operating lease at commencement does not differ from when an operating lease was effectively entered into under ASC 840.

The lessor will continue to keep the asset on the books and depreciate it as they normally would under the previous standard. The lessor will recognize lease revenue on a straight-line basis and account for any differences in cash received using a deferred rent receivable or a deposit liability account. The balance sheet will continue to display the operating lease assets separately, along with the associated accumulated depreciation. Initial direct costs that are a direct result of lease execution, as stated in section 842-10-30-9 and 842-10-30-10, will be expensed over the lease term. Meanwhile, all other costs will be expensed immediately (See ASC 842-30-25-11). Previously, under ASC 840, all initial direct costs would have been capitalized.

Lastly, the lease revenue and depreciation expense will be presented on a gross basis in the income statement. As you can see, lessors will not need to substantially change their process when transitioning their operating leases over to ASC 842.

Operating lease journal entries

As stated above, the required journal entries at commencement and subsequent measurement will not change from a lessor’s perspective under ASC 842. See below for a scenario and subsequent journal entries:

Lease term: 2 years

Useful life of asset: 8 years

Fair value/historical value of asset: $40,000

Monthly payment: $600 year 1, $700 year 2

Journal entry at commencement of the lease: No entry necessary. Continue to hold the asset and depreciate it as normal.

Subsequent monthly entries: Lease Revenue will be recognized on a straight-line basis over the entire lease term. The difference will be held in deferred rent receivable. The deferred rent receivable balance will reverse out completely at the end of the lease term. See below for an example.

| Monthly Entry Year 1 | Debit | Credit |

| Cash | $600 | |

| Deferred Rent Receivable | $50 | |

| Lease revenue | $650 |

| Monthly Entry Year 2 | Debit | Credit |

| Cash | $700 | |

| Deferred Rent Receivable | $50 | |

| Lease Revenue | $650 |

Financial statement impact

The lessor will present the operating lease as property, plant, and equipment (PPE) or a separate line item for assets subject to operating leases. PPE may be presented net of accumulated depreciation or disclosed in the notes to the financial statements. Lessors may show deferred rent receivable (as demonstrated above) or prepaid rent for initial direct costs.

Lease payments and variable lease payments will be recorded on the income statement as income to the profit or loss line item. Initial direct costs related directly to lease execution will be capitalized, then expensed over the course of the lease term. Depreciation expenses should be expensed as usual and should not be offset by rental income.

Automating leases with NetLessor

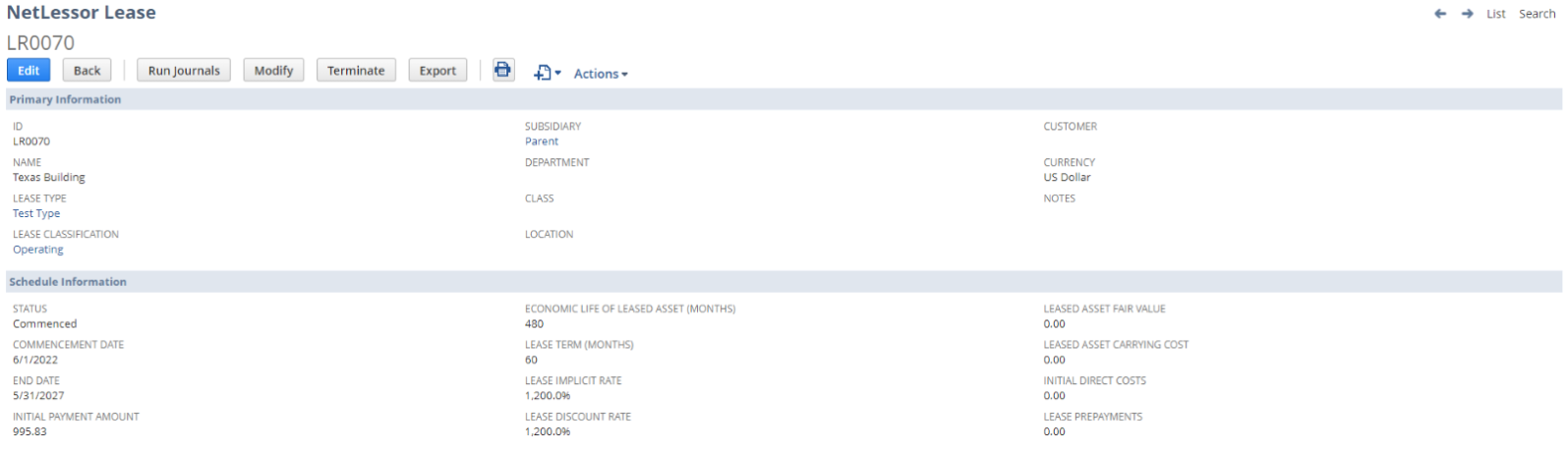

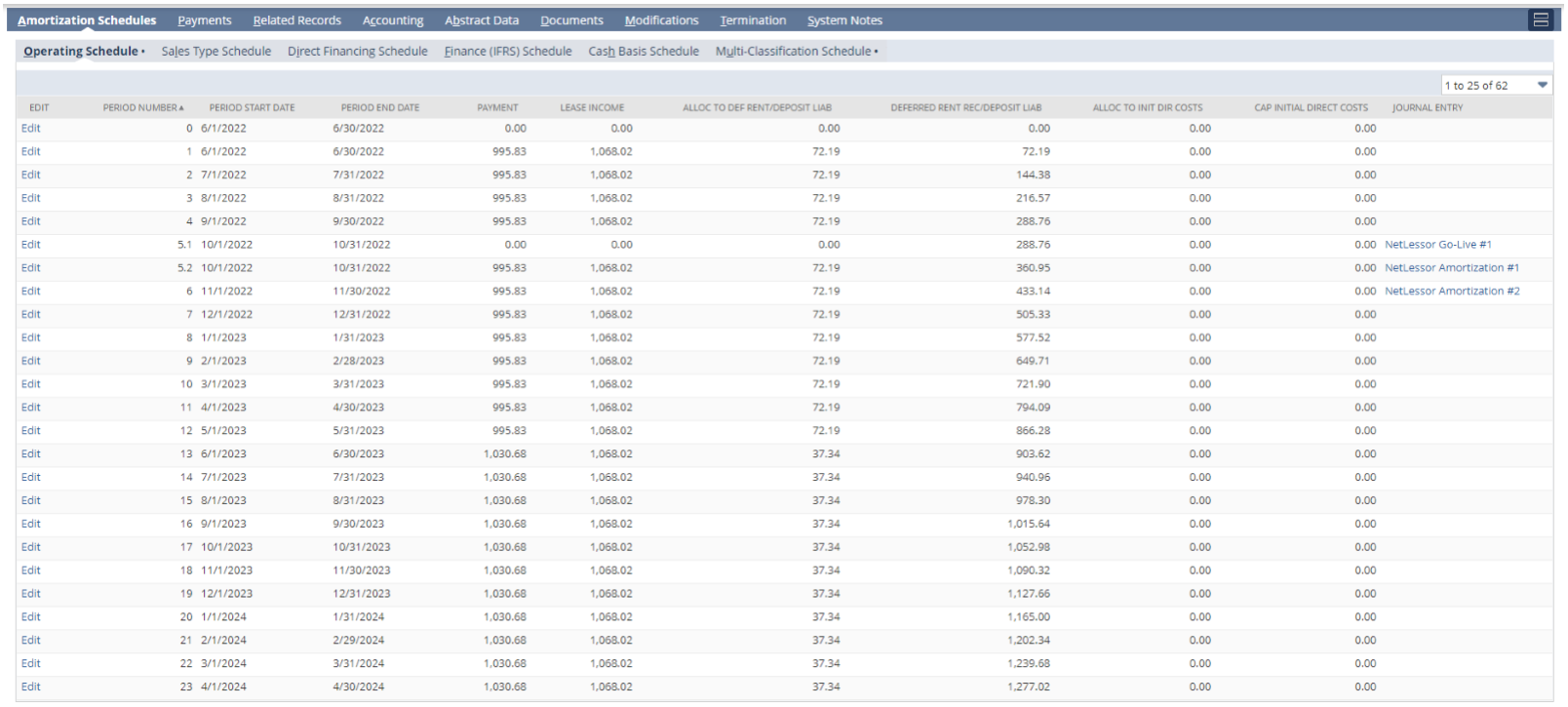

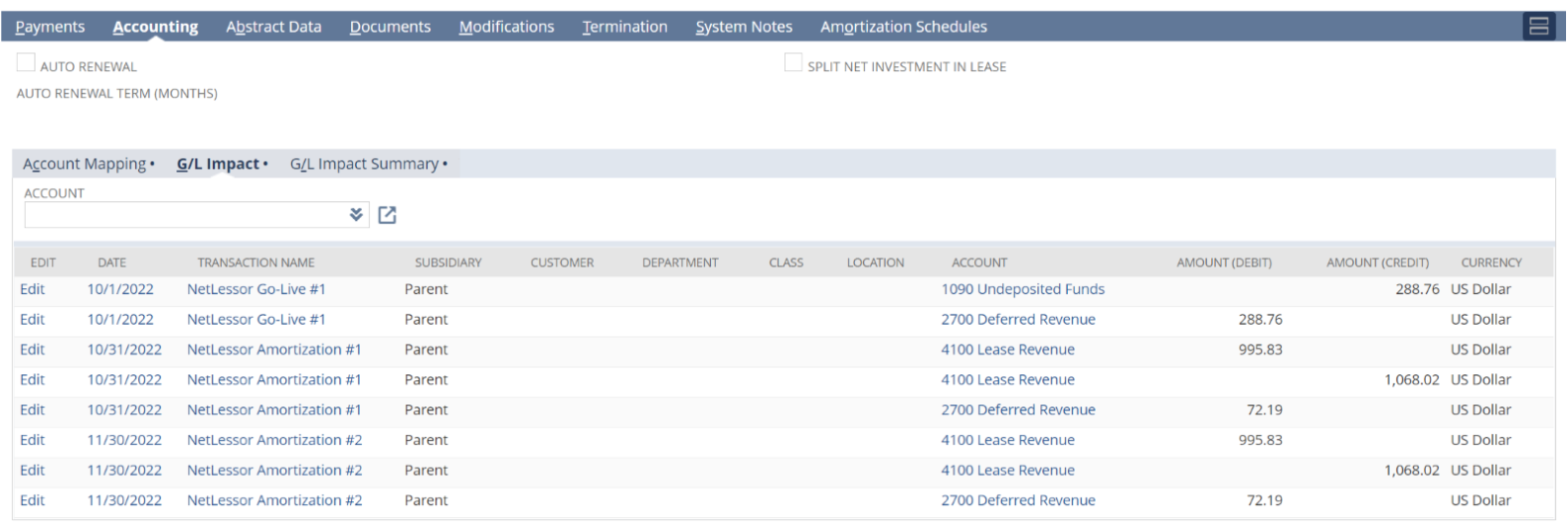

Netgain’s suite of applications allow lessors to automate the accounting for any type of lease. NetLessor provides seamless integration for companies to track their individual leases and automatically determine the classification for each transaction.

NetLessor will generate the amortization schedules and handle the required journal entries at commencement. NetLessor allows for the subsequent monthly journal entries each month.

Bottom line

As a lessor, it can be daunting to start generating journal entries for your operating leases post-transition. However, keep in mind that lessors face only minor changes in their accounting treatment for operating leases. If you are looking to streamline your lease process, consider exploring some of Netgain’s specialized tools for lessors such as NetLessor. Using NetLessor you will be able to automate the accounting for any type of lease.

About the Author

David Corbett, CPA, is a Senior Consultant at Netgain. After receiving his Masters of Accounting, he began his career in the Assurance practice at EY. During his time at EY, he audited both public and private companies which included ensuring compliance for complex transactions and technical accounting revenue recognition (ASC 606). David is excited to pursue his passion and further serve his clients by utilizing technology to save companies time and money.

David Corbett, CPA, is a Senior Consultant at Netgain. After receiving his Masters of Accounting, he began his career in the Assurance practice at EY. During his time at EY, he audited both public and private companies which included ensuring compliance for complex transactions and technical accounting revenue recognition (ASC 606). David is excited to pursue his passion and further serve his clients by utilizing technology to save companies time and money.