Following the guidance found in ASC 250, changes in accounting principles should be disclosed in the notes to the financial statements. The transition for lessors and lessees from ASC 840 to ASC 842 is considered a change in accounting principle and requires a transition disclosure.

Writing accounting memos and disclosures can be time-consuming and confusing. At Netgain, we want this disclosure to be an easy addition to the notes to your financial statements. That’s why we have prepared this ASC 842 Transition Memo Template.

This template provides a thorough example of how to write the ASC 842 transition disclosure.

Bottom Line

The ASC 842 Transition Memo is an important part of financial disclosures this year. Save yourself some time and start with ours. For all other disclosures, turn to NetLease.

ASC 842 Transition Disclosure Template Full Text

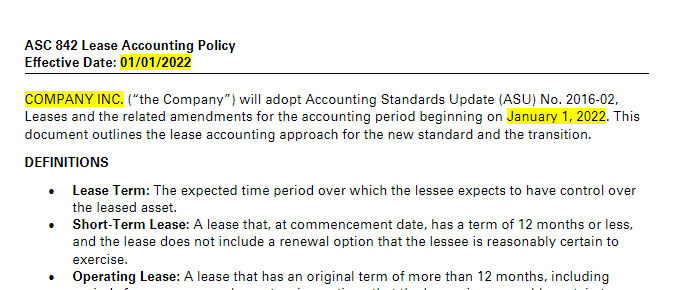

ASC 842 Lease Accounting Policy

Effective Date: 01/01/2022

COMPANY INC. (“the Company”) will adopt Accounting Standards Update (ASU) No. 2016-02, Leases and the related amendments for the accounting period beginning on January 1, 2022. This document outlines the lease accounting approach for the new standard and the transition.

DEFINITIONS

Lease Term: The expected time period over which the lessee expects to have control over the leased asset.

Short-Term Lease: A lease that, at commencement date, has a term of 12 months or less, and the lease does not include a renewal option that the lessee is reasonably certain to exercise.

Operating Lease: A lease that has an original term of more than 12 months, including periods from any renewal or extension options that the lessee is reasonably certain to exercise and does not meet the criteria below for a finance lease.

Finance Lease: A lease that has an original term of more than 12 months, including periods from any renewal or extension options that the lessee is reasonably certain to exercise and meets one of the criteria below for a finance lease:

- Ownership Transfers: Ownership of the underlying asset transfers to the lessee at the end of the lease term.

- Written Option: Lessee has an option to purchase the underlying asset that the lessee is reasonably certain to exercise.

- Net Present Value: Net present value of the sum of the lease payments and any residual value guaranteed by the lessee (that is not otherwise included in the lease payments) is a substantial percentage of the value of the underlying asset.

- Economic Life: Lease term is for a major part of the remaining economic life of the underlying asset.

- Specialized Nature: Underlying asset is specialized enough in nature that it is expected to have no alternative use to the lessor at the end of the lease term.

Variable Payments: Payments made by a lessee to a lessor for the right to use an underlying asset that vary because of changes in facts or circumstances occurring after the commencement date, other than the passage of time (CPI increases, percentage rent, etc.).

Non-Lease Component Payments: Payments made by a lessee to a lessor that are not for the right to use the underlying asset (common area maintenance, insurance, etc.).

Incremental Borrowing Rate: The rate of interest that a lessee would have to pay to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment.

ACCOUNTING TREATMENT

1. Short Term Leases

i. Short term leases will be expensed on a straight line basis over the lease term, with differences between lease payments and lease expenses being recorded to deferred rent.

2. Operating Leases

i. Operating leases will be recorded through a right of use asset and lease liability on the balance sheet. The lease liability will be recorded at a present value with an incremental borrowing rate (or rate implicit in the lease). The lease liability will be reduced as lease payments are made throughout the life of the lease. The right of use asset will be reduced as lease expense is recognized on a straight line basis throughout the life of the lease. The total lease expense will be equal to the total lease component payments made for the lease.

3. Finance Leases

Finance leases will be recorded through a right of use asset and lease liability on the balance sheet (same as operating leases). The lease liability will be recorded at a present value with an incremental borrowing rate (or rate implicit in the lease). The lease liability will be reduced as lease payments are made throughout the life of the lease. The initial right of use asset value will be amortized over the life of the lease on a straight line basis. Interest expense will also be recognized based on the lease liability and the rate used. The sum of the right of use amortization and the lease expense will equal the total lease component payments made for the lease.

4. Variable Payments

i. Variable lease payments will be recognized as lease expenses in the period in which they are incurred.

Non-Lease Component Payments

ii. Non-lease component payments will be recognized when they’re incurred in the appropriate GL account (not lease expense).

TRANSITION CONSIDERATIONS

- Leases previously classified as capital leases under ASC 840 will be classified as finance leases under ASC 842 (ASC 842-10-65-1f).

- Leases previously classified as operating leases under ASC 840 will be classified as operating leases under ASC 842 if they have a lease term greater than 12 months (ASC 842-10-65-1f).

- The Company will use the modified retrospective approach (ASU 842-10-65-1) under which leases existing at or entered after January 1, 2022, will be recognized and measured. Prior period amounts are not adjusted and continue to be reflected in accordance with the company's historical accounting.

a. Lease Terms

i. The remaining lease term of the leases under ASC 840 will be used in measuring the initial lease liability and the right-of-use asset.

b. Valuation

i. Operating Leases

1. The Company will measure the lease liability based on the remaining lease payments from the transition date.

2. The right of use asset will equal the lease liability adjusted for the deferred rent balance immediately prior to the adoption date.

ii. Transfer from Capital Lease to Finance Lease

1. Capital lease assets and accumulated depreciation on the balance sheet as of December 31, 2021, will be derecognized.

2. Capital lease debt obligations on the balance sheet as of December 31, 2021, will be derecognized.

3. The liability and ROU will be measured using the remaining term, contract rate, and discount rate as discussed in the Discount Rate section below.

4. Discount Rate:

i. The discount rate used will be based on the Company’s incremental borrowing rate as of the transition date of December 31, 2021.