ASC 842 is a hot topic for most US companies today, especially if you hang around the accounting department. This new accounting standard is intended to paint a clearer picture of a company’s true liabilities by placing (nearly) all leases on the balance sheet. So, if your business leases anything (office space is most common) then you are likely affected by ASC 842. Since many companies are still reeling from ASC 606, the new revenue recognition standards, very few have had the time to get into the weeds on the new lease accounting standards. To help you get up to speed on ASC 842, we’ve put together this quick guide on what you need to know.

History

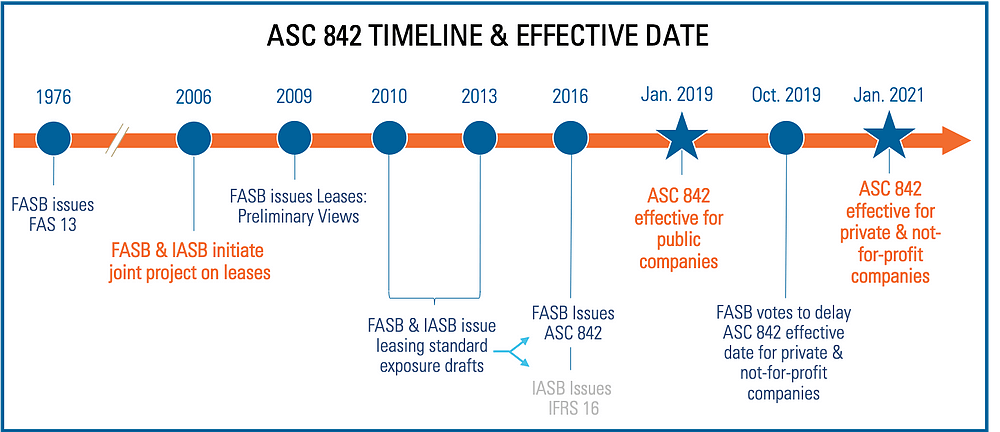

Although it may seem like ASC 842 arrived overnight, the new lease accounting standard has been in the works for almost 15 years. Many prominent businesses leveraged loopholes in the old standard to structure lease agreements to ensure they were off balance sheet, and therefore skewed financial ratios in a more favorable direction. Because of this abuse, the SEC stepped in and sent a letter to the FASB (US Financial Accounting Standards Board) and IASB (International Accounting Standards Board) asking them to take action and develop a standard that more accurately reflects a company’s true liabilities.

With that little nudge from the SEC, the FASB and IASB initiated a joint project to develop a new lease standard, but went separate ways in 2016 due to differing opinions on whether or not to maintain lease classifications (operating versus financing) in the new standard. When the FASB first issued the new standard, ASC 842 was to be effective for public companies on January 1, 2019 and for private and not-for-profit organizations on January 1, 2020. However, after seeing the difficulties public companies faced in adopting the new standards, the FASB voted to give private & not-for-profit companies an additional year to comply. Here’s a timeline of ASC 842:

What’s Different?

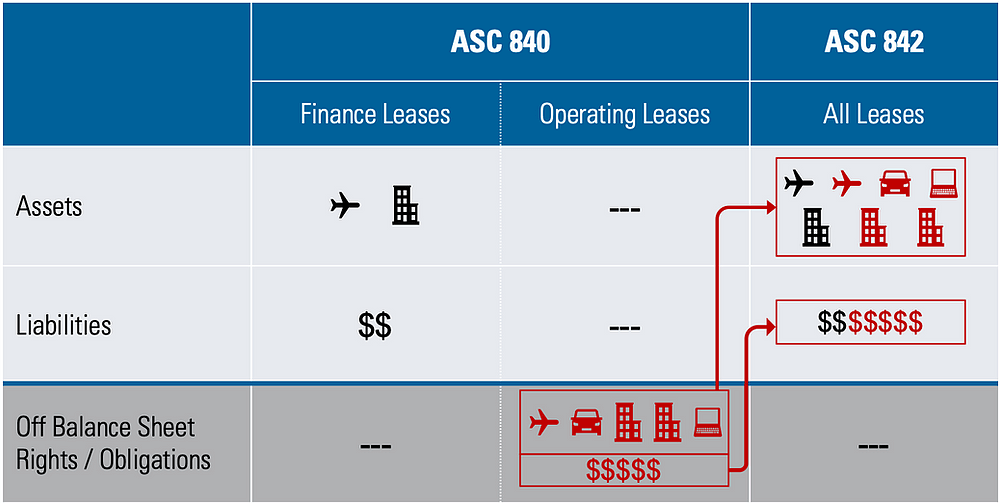

Under ASC 840, only capital leases were captured on the balance sheet, while operating leases were off-balance sheet and reflected only in the P&L. Leases were classified based on strict guidelines, called “bright lines.” This classification system gave companies the ability to generate lease agreements so that they would qualify as an operating lease, when in substance they more closely resembled a capital lease, and therefore remained off the balance sheet.

Now, under ASC 842 virtually all leases must be reflected on the balance sheet. At the time the lease is commenced, a new “right of use” (ROU) asset account is introduced for all lease types, and a “lease liability” is recorded. The biggest impact of this change is on operating leases. Here’s a summary of this change:

The P&L

As mentioned earlier, the FASB and IASB began working together to create a consistent standard across the two accounting boards. However, they had differing opinions on how to handle the presentation of operating and finance leases on the income statement. The IASB decided to reduce complexity and eliminated the operating classification, but the FASB elected to maintain a distinction between operating and finance leases. In the case of operating leases, an operating cost expense is recorded and included in EBITDA. For financing leases depreciation and interest expenses are recorded below EBITDA.

Accounting Under ASC 842

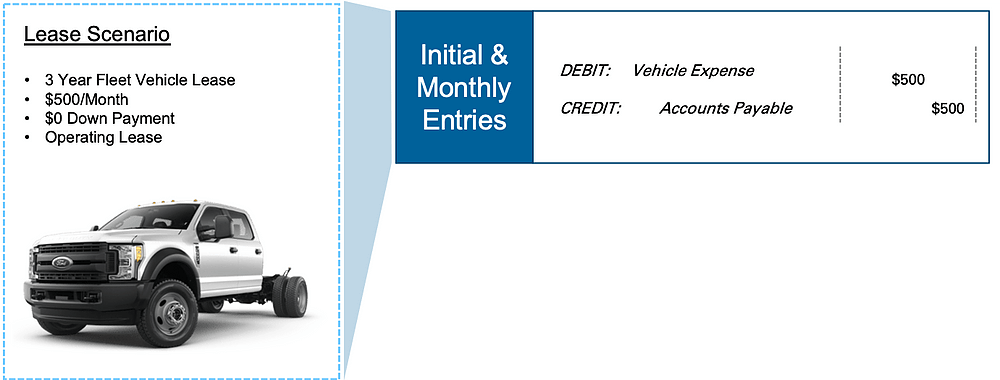

Under the old standard, a fixed-payment operating lease was simple, and monthly entries were all the same:

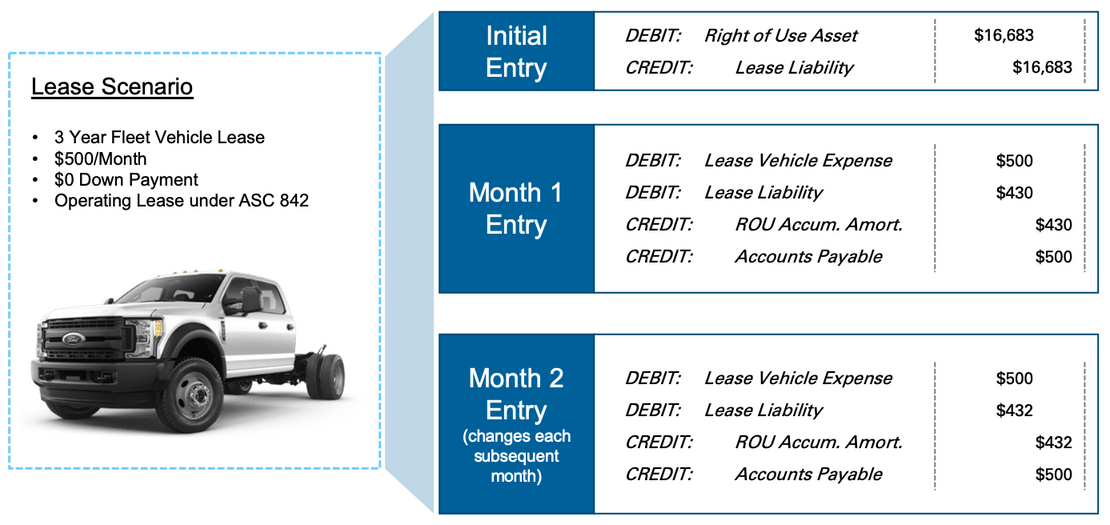

Under ASC 842, the same scenario is much more complex:

Under the new standard, there’s an initial journal entry and subsequent journal entries that change each month:

- Initial Journal Entry: When the lease is commenced, a lease liability is recorded, which is equal to the present value of all future lease payments. A right of use asset is recorded for the same amount and adjusted for initial direct costs, prepayments, or incentives.

- Subsequent Journal Entries: Accounting for operating leases is the new concept to understand. Lease expenses must still be recorded on a straight-line basis, and the liability is brought down using the effective interest method. The imbalance between decreasing interest accretion and a constant expense, requires companies to “plug” their monthly draw-down of their ROU asset via accumulated amortization. The plug amount will typically increase over the lease term, as shown in the example above.

Practical Expedients & Other Transition Relief

In order to make the transition to ASC 842 a little easier, the FASB has provided some practical expedients and other transition relief. Here are a few to be aware of:

Contract Assessments

Companies are not required to reassess whether a contract is or contains a lease at the date of initial application. This must be disclosed and consistently applied.

Cumulative Catch-Up Versus Full Retrospective

Full retrospective requires that companies prepare financial statements as if ASC 842 has always been in effect for all periods presented. To make this easier, companies can use a cumulative catch-up approach where the cumulative effect of adopting ASC 842 is recorded against retained earnings at the date of initial application. Whichever option is selected must be disclosed and consistently applied.

Hindsight

This allows companies to maintain the current accounting based on its original assessment of lease terms. This can be applied on a lease by lease basis.

Short Term Leases

Leases with terms under one year can be accounted for under the old method.

Discount Rates

When you are not able to determine the rate implicit in the lease, companies can use their risk-free interest rate. This can be applied on a lease by lease basis.

Combination of Lease & Non-Lease Components

Instead of separately allocating the lease and non-lease components of each lease, companies can elect to combine all payments and reflect that in the ROU asset, lease liability, and monthly lease expense.

Recommended Next Steps for Companies Impacted by ASC 842

Although private and not-for-profit companies were given an additional year to comply with ASC 842, it doesn’t mean these businesses should delay implementing the new standard. Here are some recommended next steps for companies impacted by ASC 842:

- Identify Leases – Start reviewing contracts and identify any that meet the definition of a lease under the new accounting standards.

- Evaluate Potential Software Solutions – Lease accounting solutions can take care of the heavy lifting at a much lower cost with lower risk than Excel. Check out more details on how to select a lease accounting software solution here.

- Start the Implementation Process ASAP – After identifying leases and selecting a software solution, begin gathering lease data in order to start the implementation of the new standard. Give your business enough time to run several rounds of journal entries before your official transition date.

To learn more about ASC 842 lease accounting, check out our video overview here.