As the private sector continues to adopt ASC 842, accounting for operating leases has become much more complicated. The main difference from ASC 840 is the requirement to recognize an asset and liability related to operating leases. This makes the differences between leasing and buying more nuanced. This article dives into the key differences in accounting calculations and the corresponding financial-statement impact for leasing vs. buying assets.

NOTE: This article does not give financial advice on whether you should buy or lease a personal car. Rather, this article discusses the accounting impact of leasing and buying assets.

See for yourself. Download our Lease vs. Buy calculator to change the assumptions and see the accounting impact your leases/loans have on your financial statements.

Leasing an Asset

Companies have the option to lease equipment, real estate, etc., for a period of time.

Considerations:

- The company does not own the asset and usually has limited liability when it comes to maintenance, repairs and upkeep.

- Because you do not have an ownership stake in the asset, you are not at risk of losing your equity if you fail to make payments.

Accounting Impact:

Under ASC 842, you are required to recognize a right of use (ROU) asset and a corresponding lease liability (assuming "operating" classification).

- The lease liability is calculated as the present value of the future lease payments discounted using the incremental borrowing rate (IBR).

- The ROU asset is the same value, but it’s adjusted for things like prepaid lease payments, initial direct costs and lease incentives.

- The lease expense is recognized in the operating section of the income statement, therefore decreasing both earnings before interest, taxes, depreciation and amortization (EBITDA) and net income.

Buying an Asset

If a company does not want to lease an asset, it has the option to purchase the asset outright or finance a portion of it to pay off over time.

Considerations:

- Choosing to purchase an asset typically requires more cash up front.

- Because you own the asset, you also increase your exposure over its useful life to costs such as maintenance, repairs, insurance, etc.

- You also run the risk of failing to keep up with loan payments and potentially losing the equity you have built.

Accounting Impact:

Like an operating lease under ASC 842, companies need to recognize an asset and liability when purchasing assets with a loan.

- Instead of an ROU asset and lease liability, the company would recognize a note payable and a fixed asset.

- The interest expenses from the loan as well as the depreciation expenses from the asset are recognized each period and decrease net income.

Accounting Summary

Let's highlight the key similarities and differences in the accounting.

- Both leasing and purchasing recognize an asset and liability.

- A lease will be recognized under the ROU asset and lease liability accounts, while purchasing is recognized under the fixed asset and note payable accounts.

- The asset and liability for an operating lease would typically be smaller, because the lease term would not be for a significant portion of the asset’s useful life

- Otherwise, it would be classified as a financing lease.

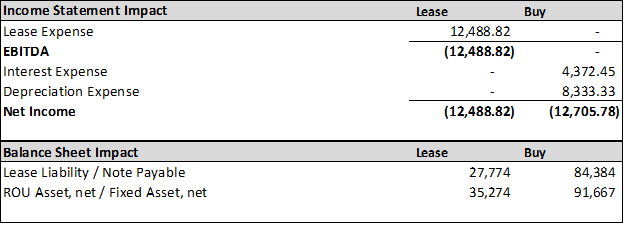

On the income statement, an operating lease will be classified as an operating expense. This means that EBITDA and net income will be impacted. If a company were to buy an asset, the expense would be allocated to interest and depreciation expense.

These expenses are below the EBITDA line, which means that they only have an impact on net income. Because many companies are valued on multiples of EBITDA, it becomes a very important decision whether to lease or buy assets because it would have a direct impact on your valuation (sometimes a 15x swing, for better or worse).

See the visual below for the accounting impact. Download our lease vs. buy calculator to change the assumptions and see the accounting impact your leases/loans have on your financial statements.

Lease assumptionsLease classification: Operating Commencement date: 11/1/2020 Lease term: 48 months IBR: 5.00% Payment timing: In arrears Prepaid lease payment: $10,000 Monthly lease payment: $832.40 |

Purchase/loan assumptionsPurchase price: $100,000 Down payment: $10,000 Useful life: 144 months APR: 5% Payment timing: In arrears Monthly loan payment: $832.40 |

Financial Statement impact after one year (as of 10/31/2021):

Bottom Line

Knowing the financial statement impact of leasing vs. purchasing is vital to your organization because it will impact financing, valuations and cash flow. Use the information above and the tools provided to explore which options are best for your organization.