With the new lease accounting standards already upon us, software companies have come forward offering competing products to help you automate your lease accounting. Time and time again, we have heard that implementing the new lease accounting standard took far more time, resources, and money than companies anticipated. In fact, many public companies with larger lease portfolios spent millions of dollars implementing, but for normal companies that’s crazy.

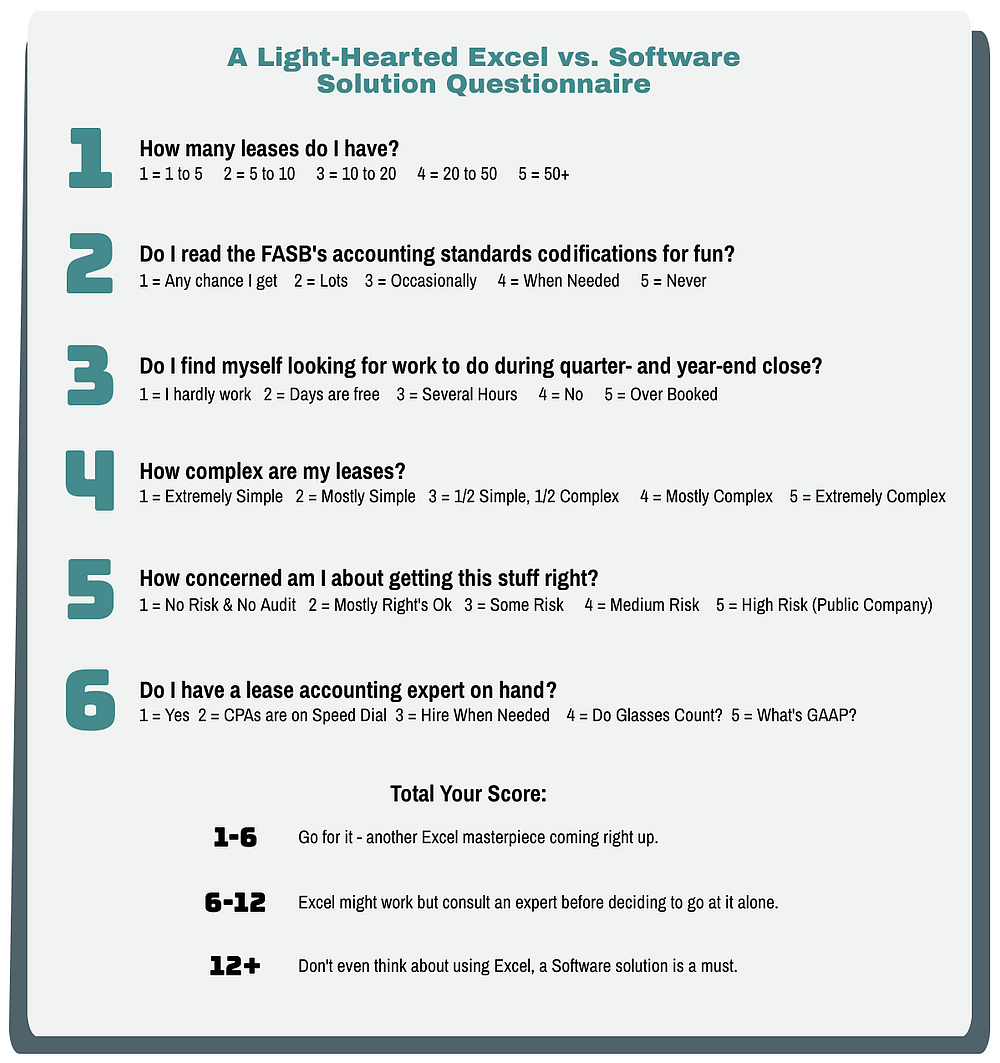

So, what should you do? Will managing your leases in Excel be sufficient, or do you need software? How much will it cost? Since most public companies have already gone through adoption and implementation, we know the right questions to ask:

How Impacted is my company?

Before building an implementation plan and roadmap, it's important to understand your lease landscape by answering the following questions.

- Do you know how many leases you have (don’t ignore the office you’re sitting in)?

- Which accounting standards are you subject to – US GAAP, IFRS or governmental?

- How complex are your leases (are there variable terms, renewal options, amendments, or other complexities)?

- Do you have an accounting expert in-house who loves accounting research?

- Does your team have enough time to allocate to adoption and implementation?

- Does your team have bandwidth for monthly lease management activities?

- Have you had adoption conversations with your CPA firm? Have they provided you a disclosure checklist to review?

- Do you know what lease data will need to be captured and tracked for reporting?

If you are more than slightly impacted based on your answers above, count on having some work to do—probably more than you’d first estimate. As you consider Excel or software, think about your more challenging leases and edge cases as you work through your options.

Can’t I just use Excel?

If you’re planning on just using Excel, you’re not at all alone. A Q4 2018 survey conducted by PWC revealed that 53% of private companies are planning on using spreadsheets. This is more than twice the percentage of public companies planning to use spreadsheets to comply. While much of that gap is probably attributed to relative size and lease volume, a concern is that private companies may be underestimating the impact, or overestimating their ability to fully comply in Excel.

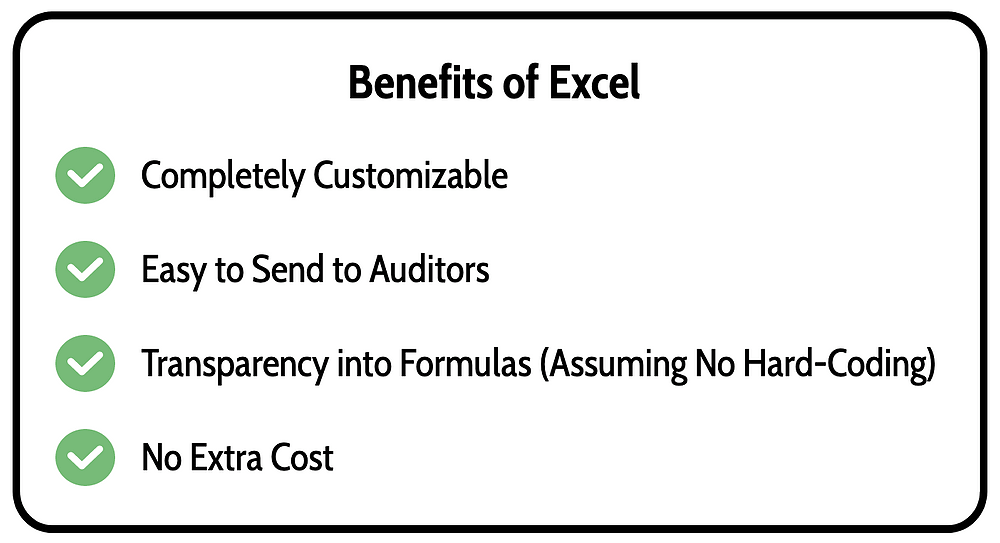

As CPAs who have spent decades manipulating spreadsheets as both public accountants and auditors, and closing the books for large companies, we get it. Excel is what we are comfortable and familiar with, and perhaps more, deep down we know we are essentially artists—and though not painted on canvas, our work should be available to be admired by all. Excel is indeed great if you have a low number of leases, have lease accounting experts on hand, sufficient resourcing, and time available to dedicate to ongoing maintenance. If your company only has one or two simple leases, Excel may indeed be the right answer.

Here’s a summary of the benefits of Excel:

However, there is a lot more to think about before going this route for more than a small handful of leases. Keep in mind that compliance is not simply developing a lease amortization schedule and booking journal entries against those period balances—this is just one step.

You will need to begin with the end in mind as you consider your lease amortization, modifications, terminations, and aggregation for reporting. You’ll run into a lot of complexities that make it difficult to accurately aggregate information and report across a larger number of leases and Excel schedules.

Furthermore, you will need to track additional lease disclosure information such as options (purchases, extensions, modifications, terminations), as well as lease and non-lease components (e.g., base/initial rent, variable payments, other fees such as CAM or taxes and insurance). Your entire schedule will need to be rebuilt when a modification occurs.

Plan to spend time developing required disclosure reports and tracking how your information will be sourced—be prepared to help your auditors tick and tie your schedules to prove out reporting accuracy (e.g., lease schedules, reconciliation reports, disclosure reports, etc.).

Why use a Software Solution?

A technology solution can help centralize all leases onto a single platform, perform calculations, assist with lease administration, and provide necessary information for reporting. Here are some of the critical benefits of using a software solution:

1. Calculate Future Lease Liability

The future lease liability is based on net present value (NPV) of future payments based on interest rates, which could differ by contract. Systems will store appropriate data and calculate the liability

2. Calculate the Right of Use (ROU) Asset and Amortization

Your ROU balance will need to be adjusted for initial direct costs, incentives, and pre-payments. Amortization will differ between operating and finance leases.

3. Separate Lease & Non-Lease Components

Contract terms may include non-lease costs, such as property taxes. Although paid together, they must be accounted for separately.

4. Track Terms Including Renewals, Options, Expirations, etc.

Relevant contract terms can be stored within the system and notifications can be generated automatically, ensuring that you never miss a key date.

5. More Comprehensive Disclosure Reporting

With all your data in a unified system, with a single click you can consolidate and disclose information about your entire lease population. A few of the new disclosures include lease costs, weighted average discount rate, weighted average term, incremental borrowing rate, and un-discounted lease maturities.

6. Centralize, Store, and Take Action Across the Lease Portfolio

Store, track, and report on key information including contract provisions, maintenance schedules, units, and usage. Controls can be established throughout the lease lifecycle.

Isn’t Software Too Expensive?

Although expensive for early adopters, it has become much more affordable as a multitude of lease solution providers compete for new, price-sensitive customers. Because lease solution providers charge based on the number of leases, the cost for companies with fewer leases can be surprisingly affordable.

In addition to reducing your compliance risk, the time saved as a result of automating your lease accounting can easily offset the software cost. Several of the largest CPA firms have found that companies can realize a positive ROI with only a few leases.