What is a leasehold improvement?

When a company enters into a real estate lease, more often than not, there are changes made to the property in order for it to be useful to the company. These changes are accounted for as fixed assets and are typically called leasehold improvements. An improvement can be performed by the landlord (lessor) or the tenant (lessee).

Key Takeaways:

-

Leasehold improvements are changes made to a property when a company enters into a real estate lease; they are accounted for as fixed assets.

-

Lease incentives, such as tenant improvement allowances, are payments made to or on behalf of the lessee and need to be accounted for as a part of the lease agreement.

-

When a leasehold improvement is paid or reimbursed by the lessor, it should be treated as a lease incentive and an asset should be recorded for the improvement/incentive. The amortization of the incentive will vary depending on if you are under ASC 840 or ASC 842.

Frequently the landlord might sweeten the deal by offering to pay for leasehold improvements that are required for the company. They might offer to replace the carpet/tiling, build additional walls, or any other improvement that gets the space ready for use. The landlord might even offer special buildouts to entice the company to renew the lease or extend the term. These incentives to lease the property are called lease incentives and need to be accounted for as a part of the lease agreement.

We see these every day in the leasing world, but how do companies account for them and how has ASC 842 changed the process?

Leasehold improvements, tenant improvements, and lease incentives

A common way lessors provide lease incentives is to give a tenant improvement allowance. A tenant improvement allowance provides the tenant the ability to perform and manage leasehold improvements within a certain dollar amount that is either paid to the third party on behalf of the lessee or as a reimbursement directly to the lessee. The allowance can be given in cash before lease commencement or anytime during the term of the lease contract.

A tenant improvement allowance is recognized as a lease incentive. As the guidance states, lease incentives include payments made to or on the behalf of the lessee.

ASC 842-10-55-30: Lease incentives include both of the following:

a. Payments made to or on behalf of the lessee

b. Losses incurred by the lessor as a result of assuming a lessee’s preexisting lease with a third party

Leasehold improvements under ASC 840

Under ASC 840 tenant improvements (lease incentives) require the incentives to be reflected as a reduction to the minimum payments. Therefore, the lessee would record an asset for the improvement, the incentive/reimbursement recorded as a deferred rent credit. The deferred rent credit is then amortized as a reduction to rent expense.

|

Example: |

|

|

Term |

24 Months |

|

Monthly Payment |

$ 1,000.00 |

|

Lease Incentive |

$ 2,000.00 |

|

Initial Balance Entry |

|

|

|

|

Debit |

Credit |

|

Improvement |

$ 2,000.00 |

|

|

Deferred Rent |

|

$ 2,000.00 |

|

Monthly Amortization |

Debit |

Credit |

|

Rent Expense |

$ 916.00 |

|

|

Deferred Rent |

$ 84.00 |

|

|

AP/Cash |

|

$ 1,000.00 |

Leasehold improvements under ASC 842

Under ASC 842, tenant improvements (lease incentives) should be recorded as a reduction of fixed payments and, in turn, reduce the Right of Use asset from the time it is capitalized at lease commencement. Similar to ASC 840, the lessee will record an asset for the improvement, but instead of recording a deferred rent credit, they will reduce the ROU asset by the same amount. The reduction in rent expense will be carried through to the amortization of the ROU asset.

|

Example: |

|

|

Term |

24 Months |

|

Monthly Payment |

$ 1,000.00 |

|

Lease Incentive |

$ 2,000.00 |

|

Initial Balance Entry |

|

|

|

|

Debit |

Credit |

|

Improvement |

$ 2,000.00 |

|

|

ROU Asset |

$ 21,751.00 |

|

|

Lease Liability |

|

$ 23,751.00 |

|

Monthly Amortization |

|

|

|

|

Debit |

Credit |

|

Rent Expense |

$ 916.00 |

|

|

Lease Liability |

$ 980.00 |

|

|

ROU Accum. Amor. |

|

$ 896.00 |

|

AP/Cash |

|

$ 1,000.00 |

If the lease incentive is scheduled to happen at a certain point in the lease, it should be included in that period's lease payment as a reduction and discounted back to the lease commencement date and recorded at its present value.

When timing of the lease incentive is uncertain, the accounting can become a little trickier. Refer to Lease Incentives: What to do when timing is uncertain.

Reminder: ASC 842 is effective as of January 1, 2022. It is time to plan a complete transition from ASC 840. Contact us for help making the transition.

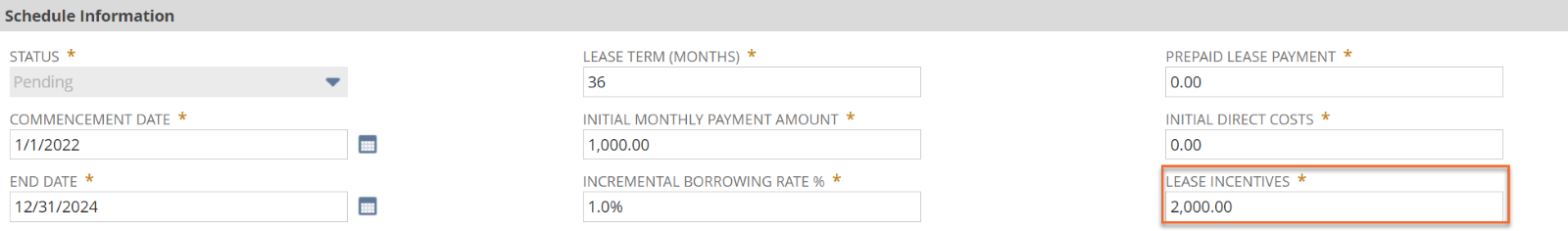

NetLease makes it easy

NetLease makes the process of adding tenant improvement allowances to your lease schedule simple and easy, whether those incentives are given before lease commencement or during the term of the lease. If the allowance is given before lease commencement, NetLease gives the ability to input the amount in a Lease Incentive field. NetLease will automatically apply that amount to the appropriate sections within the schedule.

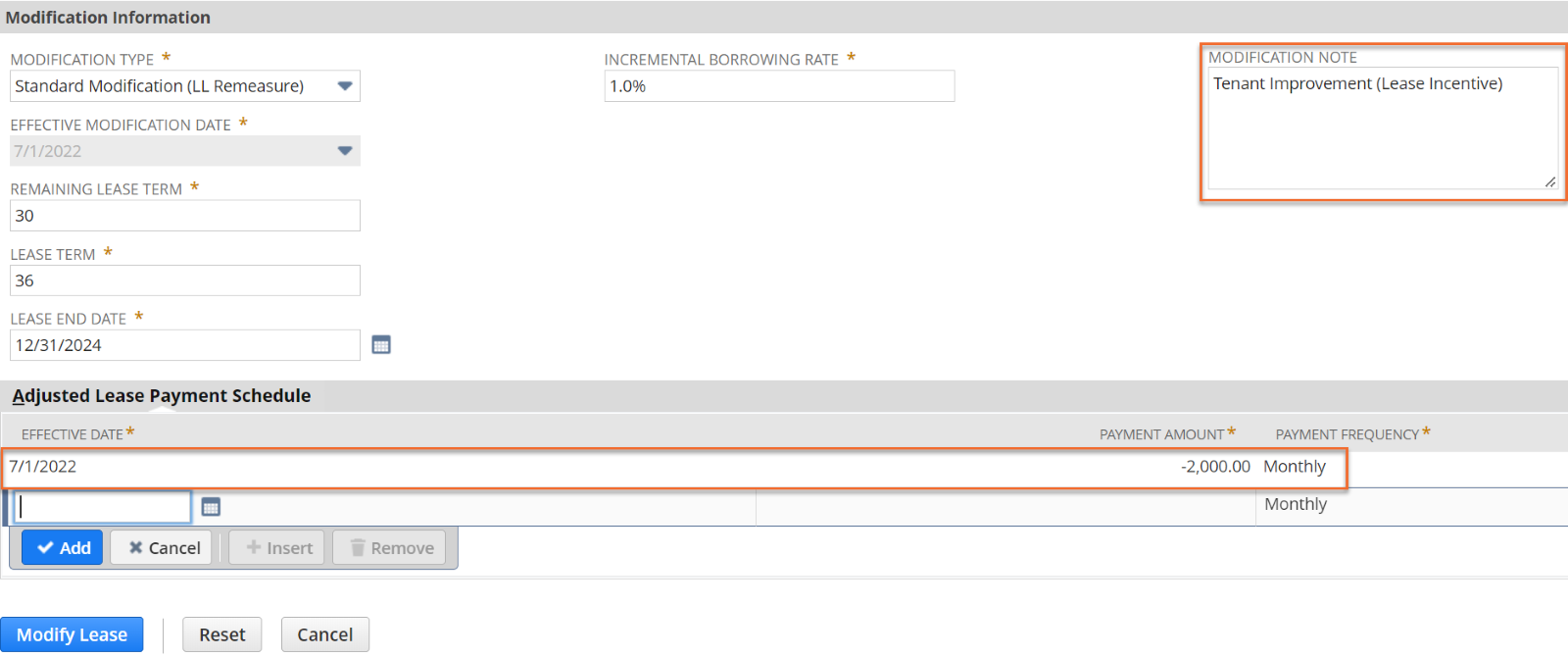

When a tenant improvement is given during the term of the lease, NetLease allows for a lease modification, where the amount can be used to adjust the payment in the period it is received. NetLease will then adjust the lease schedule based on the new information.

Bottom line

When a leasehold improvement is paid or reimbursed by the lessor, it should be treated as a lease incentive. Whether you are on ASC 840 or ASC 842, the lessee should still record an asset for the improvement/incentive. The difference between the two is how you amortize the incentive. Under ASC 840 you amortize a deferred rent credit account and under ASC 842 the amortization flows through to the reduced ROU asset.

FAQs

How do I account for tenant improvement allowances?

Tenant improvement allowances are amounts of money that the landlord agrees to contribute towards the cost of improvements made to the leased space for the tenant's benefit. These allowances often pay for costs incurred when a tenant moves to the new property, such as revamping floors or windows.

And it can be given in cash before lease commencement or anytime during the term of the lease contract. Accounting for tenant improvement allowances is dependent on whether the landlord or the tenant funds, oversees, and owns the improvements.

Is tenant improvement allowance income?

No, tenant improvement allowance (TIA) is not considered income. TIA is typically negotiated as part of the lease agreement between the landlord and the tenant, and it can be used to cover the cost of construction, renovation, or other improvements to the leased space that are required by the tenant. The amount of TIA provided by the landlord can vary, and it may be provided as a lump sum or as a reimbursement for specific expenses.

It's important to note that while TIA is not considered income, it may have tax implications for the tenant. Depending on the specific circumstances, the use of TIA funds may be subject to certain tax rules and regulations, so it's always a good idea to consult with a tax professional for advice.

Are tenant improvements amortized?

Yes, tenant improvements are typically amortized over the life of the lease. “Amortization is an accounting technique that reduces the book value of a loan or intangible asset over a specified period of time. Typically, the amortization is repaid in installments over the lease term, with interest.” These improvements can be quite costly, and it may not make sense for a landlord to expense the entire cost in the year the improvement is made.

Instead, the landlord can choose to amortize the cost of the tenant improvements over the expected useful life of the improvement. The amortization period for tenant improvements will depend on various factors, such as the nature of the improvement, its expected useful life, and any applicable tax regulations.

Should tenant improvements be capitalized?

Yes, tenant improvements should be capitalized as they are long-term assets that add value to a property. Tenant improvements that extend the useful life of the property, enhance the property's value or functionality, and increase the property's capacity or productivity should be capitalized.

Capitalizing the cost of tenant improvements means that the cost is recorded as an asset on the balance sheet and is depreciated over the useful life of the improvement.

Is tenant improvement an expense?

Yes, tenant improvement is an expense. It is an expense incurred to alter or remodel a rental property to make it suitable for a tenant. This can include painting, replacing carpets, installing new fixtures, and more. However, from an accounting perspective, tenant improvements can be treated as either an expense or a capital expenditure, depending on the nature and cost of the improvements.

If the improvements are considered routine maintenance or repairs, they are typically expensed as incurred. However, if the improvements are significant and increase the value of the property, they may be capitalized and depreciated over time.