We live in a world with nearly unlimited options. So why should software be any different? With the new lease accounting standards, ASC 842, IFRS 16 and GASB 87, more and more software vendors are releasing products to help companies properly account for leases under the new standard. Avoid choice overload by employing the following tactics to more effectively and confidently select your lease accounting software.

Step 1: Identify Your Key Business Requirements

Start by analyzing your current process. What aspects of your lease operations are essential for compliance and administration? Additionally, what are the biggest pain points in the current process? Make a list of the essential features that your business is looking for in the new application. Here are some of the common needs our clients have as it relates to lease accounting:

- Compliant with New Accounting Standards (ASC 842, IFRS 16, GASB 87)

- Real Estate & Lease Management Capabilities

- Asset Maintenance Tracking

- Contract Management

- Capital Project Administration

- Facilities Management & Space Utilization Monitoring

- FX Considerations

- Multi-Book Reporting

- Lessor Accounting Needs

Step 2: Prioritize Your Needs & Assign Relative Importance

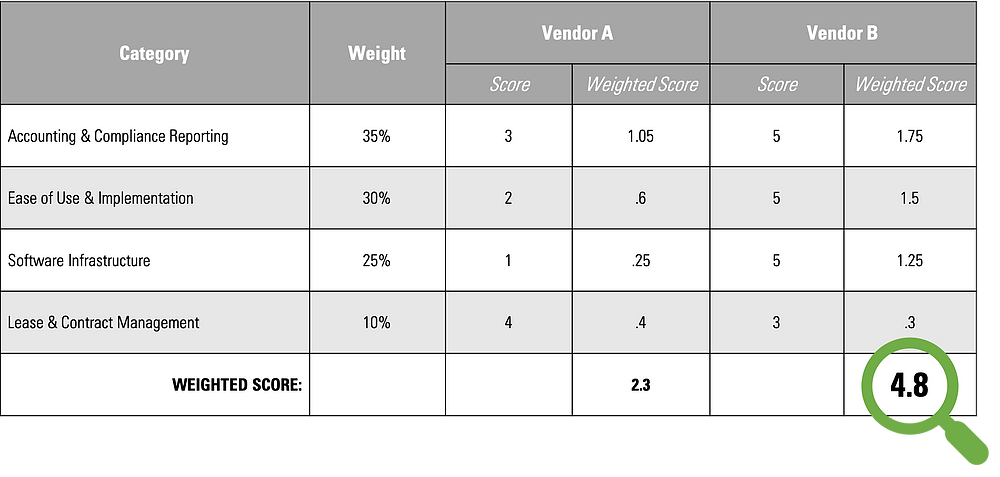

Software solutions will be able to meet those needs to varying degrees so it’s important to identify your primary, secondary and nice-to-have requirements. Create a scorecard that lists your required features on the left and weight each feature based on your priority (see the end of this post for a simple example).

Step 3: Determine What Solutions Are Available

Based on the needs identified in step one, create a short list of solutions that may meet those requirements. In this step, you may identify that a handful of vendor solutions, an existing solution provided within your ERP software, Excel and a homegrown approach are all possible options. RSM strongly recommends utilizing a vetted software solution if your lease portfolio contains more than 15-20 records.

Step 4: Schedule Demonstrations & Know What to Ask

Once you’ve determined that you need a software solution, identify vendors you’d like to review, and schedule product demonstrations. Leading up to the demonstration, RSM strongly recommends providing examples of your most complex leases under the new standard. During the demonstration, ensure that the solution is able to properly account for that lease.

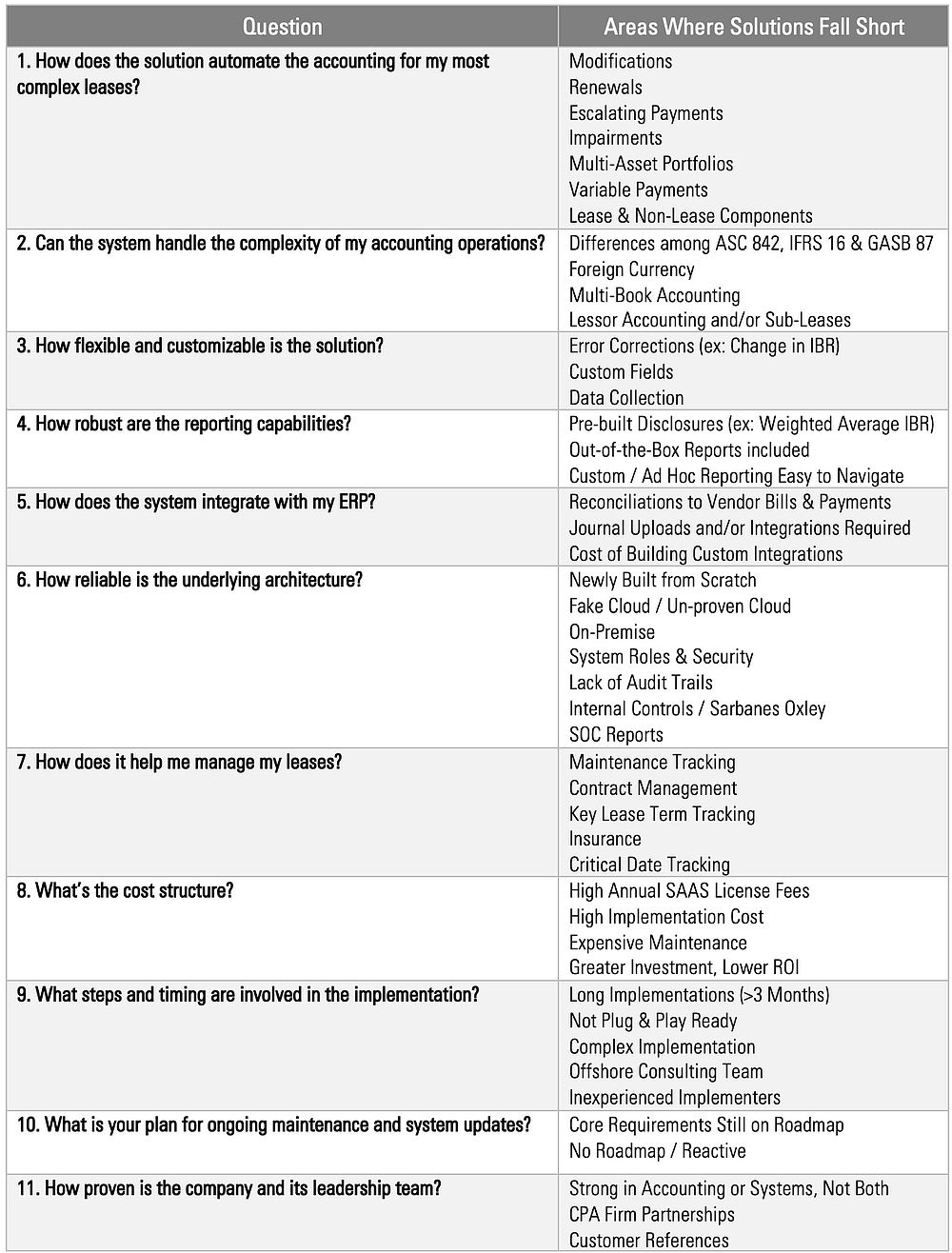

Here are some must-ask questions to address with vendors during the demonstration, and some common areas where solutions fall short to watch out for:

Step 5: Weigh Your Options in a Software Solution Scorecard

Rate each vendor based on the answers to the above questions. In our basic example below, we’re rating two vendors based on four main categories – accounting & compliance, ease of use & implementation, software infrastructure, and lease & contract management. Multiply each score by the associated weight percentage created in step two to get category scores based on priority and sum the results. The outcome is a weighted score by vendor that can be utilized to make an objective decision.

Here’s a simplified example scorecard to help identify the right lease accounting software for our clients:

Step 6: Assess the Value Based on Weighted Scores & Cost

At this point you know what vendor’s functionality aligns best with your business priorities. However, budgets are always top of mind and an important factor in making your final decision. Make sure to assess each vendor based on the value it brings and avoid sacrificing important functionality due to cost.

Step 7: Understand Vendor Support

Understanding the support structure (including the upgrade process/cadence, and support team reliability) is an important factor to consider before signing the dotted line. Take the time to make certain that your vendor has a dedicated support team with the capacity to assist you during the implementation and thereafter. Additionally, gaining an understanding of the upgrade process is key. Is there a history of upgrades affecting the current-state accounting of live customers? How often and in what manner are any system upgrades deployed?

If you’d like a more in-depth analysis of vendors on the market, reach out to Weston Lampe (weston.lampe@rsmus.com) at RSM for more information.