Lease incentives are cash concessions received from a lessor that reduce the lease expense recognized over the term of a lease. These lease incentives can be received before a lease begins or during the life of the lease. When the timing of those payments is certain, the accounting is pretty straightforward. If the payment is received before lease commencement, it should reduce the Right of Use asset from the time it is capitalized at lease commencement. If it is scheduled to happen at a certain point in the lease, it would be entered into the lease payment schedule and discounted back to the lease commencement date and recorded at its present value.

Inside of NetLease, lease incentives should be entered either in the Lease Incentives field on the lease record, or as a reduction to the payment amount in the month that it occurs. (This can be negative if the payment received is greater than what is paid for that month.)

Uncertain Timing

Things can get much stickier when the timing of a lease incentive is uncertain. Netgain’s recommended approach is to include the lease incentive in the Lease Incentives field when entering the lease and track future receipts offline. When a payment is received after commencement date, start by making the following journal entry.

At lease commencement:

Record the entire lease incentive amount into the Lease Incentives field on the lease header. (NetLease will debit ROU Clearing for the amount of the lease incentive.)

Reclassify unpaid lease incentives from your ROU Clearing Account into a debit balance short term lease liability contra account.

- Debit: Lease Incentive Receivable

- Credit: ROU Clearing

Upon receipt of the lease incentive, record the following entry:

- Debit: Cash

- Credit: Lease Incentive receivable

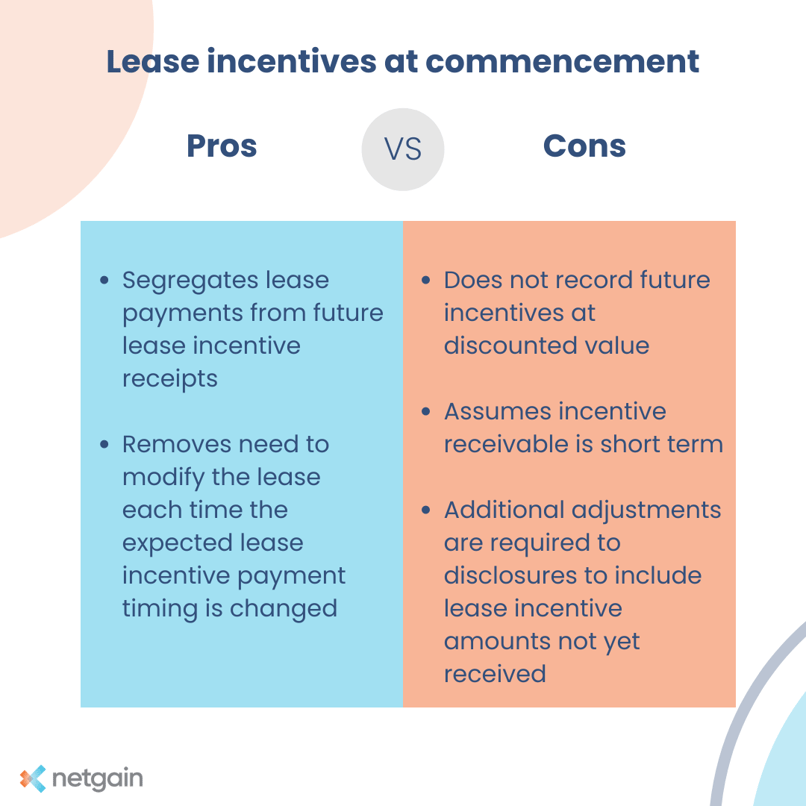

This approach has pros and cons that need to be considered.

Pros of this approach:

- Segregates lease payments from future lease incentive receipts.

- Removes need to modify the lease each time the expected lease incentive payment timing is changed.

Cons of this approach:

- Does not record future incentives at discounted value. It is misstated by the discounting on the lease incentive; however, this timing is uncertain anyway.

- Assumes incentive receivable is short term (due within 12 months).

- Additional adjustments required to disclosures to include lease incentive amounts not yet received.

The bottom line

However you decide to recognize the lease incentive, remember that under ASC 842, you must have the incentive recorded in the account books. Use the straight-line expense method for an operating lease, whether you record it at lease commencement, or later, when the incentive is received.