When entering into a lease, there are many things to consider: the classification of lease, the length of the lease, the incremental borrowing rate (IBR) used in the lease, and all other relevant lease traits. However, one aspect of a lease that you won’t be able to forecast is a lease modification. A lease modification can be caused by many different events, and the modification can be tedious, confusing, and difficult to implement into your lease schedule. Trying to recalculate a lease after a modification, especially in Excel, can cause quite a headache. That’s why this article uses a software solution, NetLease, to illustrate how to perform a modification easily.

What is a modification?

Let’s start by defining what a lease modification is and the different types of modifications. Defined by US GAAP ASC 842 Glossary:

A lease modification is a change to the terms and conditions of a contract that results in a change in the scope of or the consideration for a lease (for example, a change to the terms and conditions of the contract that adds or terminates the right to use one or more underlying assets or extends or shortens the contractual lease term).

When trying to decide if a lease modification is present, there are a few different scenarios that can result from a modification.

Scenario 1

When an additional right-of-use (ROU) asset is created from a modification with its own standalone price, this results in a new and separate lease altogether.

- Example: A company expands a lease from one building to another building, a new separate lease is associated with an additional ROU asset.

Scenario 2

When a modification to the lease contract occurs, and the ROU asset and lease liability are remeasured, this is a standard lease modification. A few examples of changes to a lease that could cause a standard lease modification include a change in future payments, a lease renewal, or a change in the incremental borrowing rate.

- Example: A landlord implements an unforeseen rent escalation; thus, the future payment schedule has changed. The lessee will need to revalue the ROU asset and lease liability for the change in the future payments.

Scenario 3

When a modification to the lease contract occurs, and a partial termination of the lease is the result, this is considered a decrease in scope or ROU impairment modification. Below is an example of changes to a lease that may cause decrease in scope modification or an impairment to the ROU asset of the lease.

- Example: A company is leasing three floors of office space. However, the lessee no longer needs all three floors, and agrees with the landlord to reduce the lease to only two floors. The lease contract will require a change in scope modification.

How to perform lease modifications under ASC 842

The hard way— spreadsheets

Performing a modification within an Excel document can be cumbersome due to its delicate nature. Within Excel, a lease amortization schedule is built from a combination of multiple formulas that flow cohesively. Once a modification is identified, the owner of the Excel document containing the lease must revalue the lease from a point in time and edit these formulas to reflect the change. There is a high risk of human error in this process.

The simple solution

The easier answer is to use custom-made software like NetLease. From here on, I will explain how to properly perform modifications in NetLease.

Standard modification.

The standard lease modification is the most common modification type, which can arise from a simple lease renewal. In those instances, you remeasure the lease liability with the adjustments being recorded against the ROU asset. There is a general ledger impact of remeasuring the lease liability and ROU, whether it be increase or decrease,; however, there is no impact to the P&L.

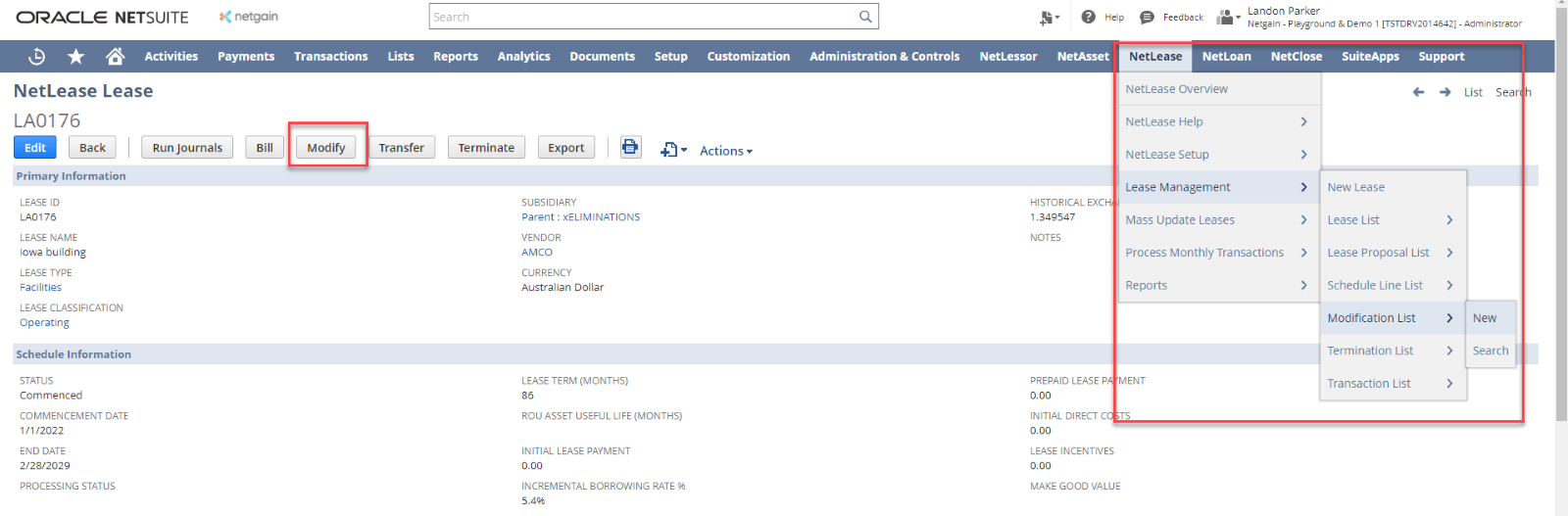

Within NetLease, you would navigate to a lease and then the modification of the lease is pushed through the amortization schedule prospectively from the effective period of the lease modification lease.

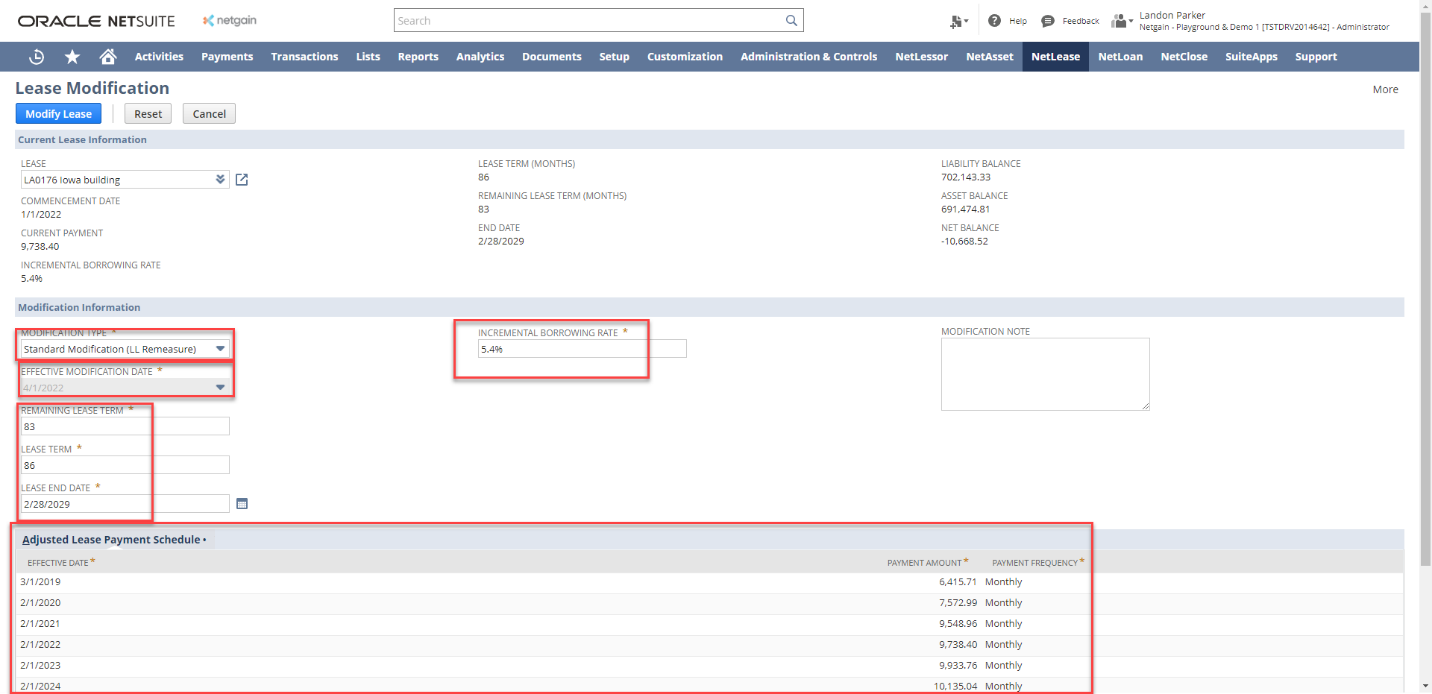

The following screenshot shows the lease modification form in NetLease once a modification has been initiated.

On this form, the modification type should be updated first to classify the correct modification, in this example “Standard Lease Modification”. Once this is selected you simply update the applicable lease characteristics.

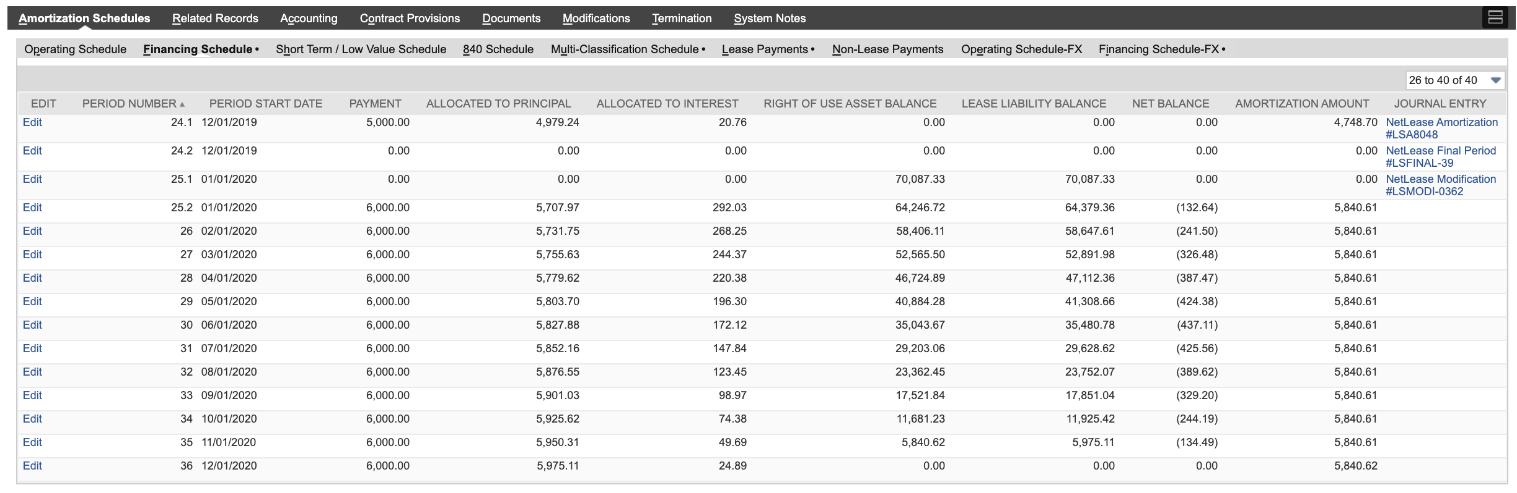

Keep reading to see a screenshot of the modification being pushed into the amortization schedule.

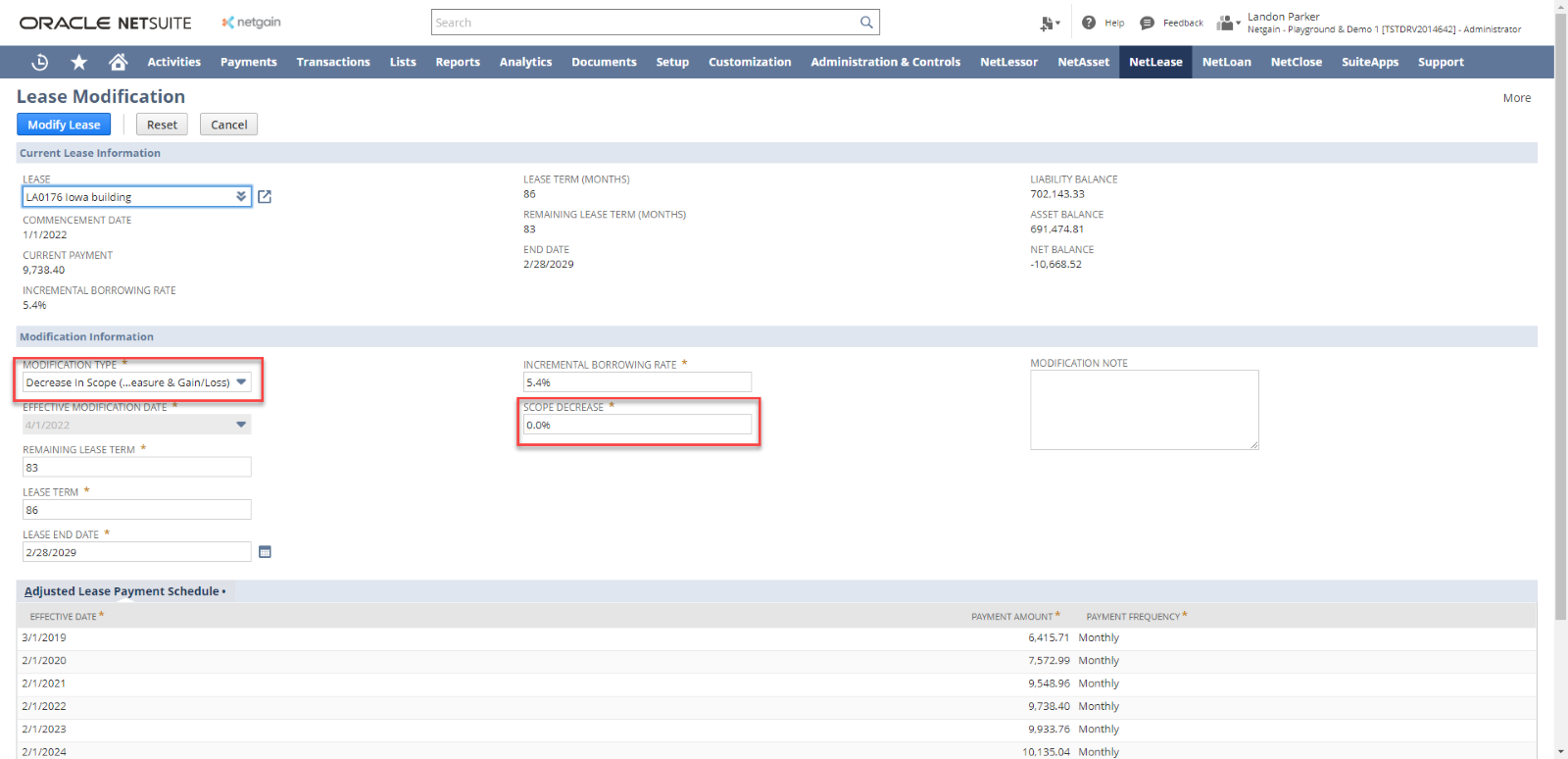

Decrease in scope/ROU impairment.

A decrease in the scope of a lease can also be referred to as a partial termination—it removes the asset or more underlying assets or shortens the contractual lease term. This can happen, for example, by modifying a lease to reduce the square footage leased in a building. There is a GL impact to the lease liability and ROU asset are decreased proportionately in scope, with the difference representing a gain/loss to the P&L.

The previous screenshot of the lease modification form within NetLease shows the decrease in scope type of modification and how to partially terminate part of a certain lease.

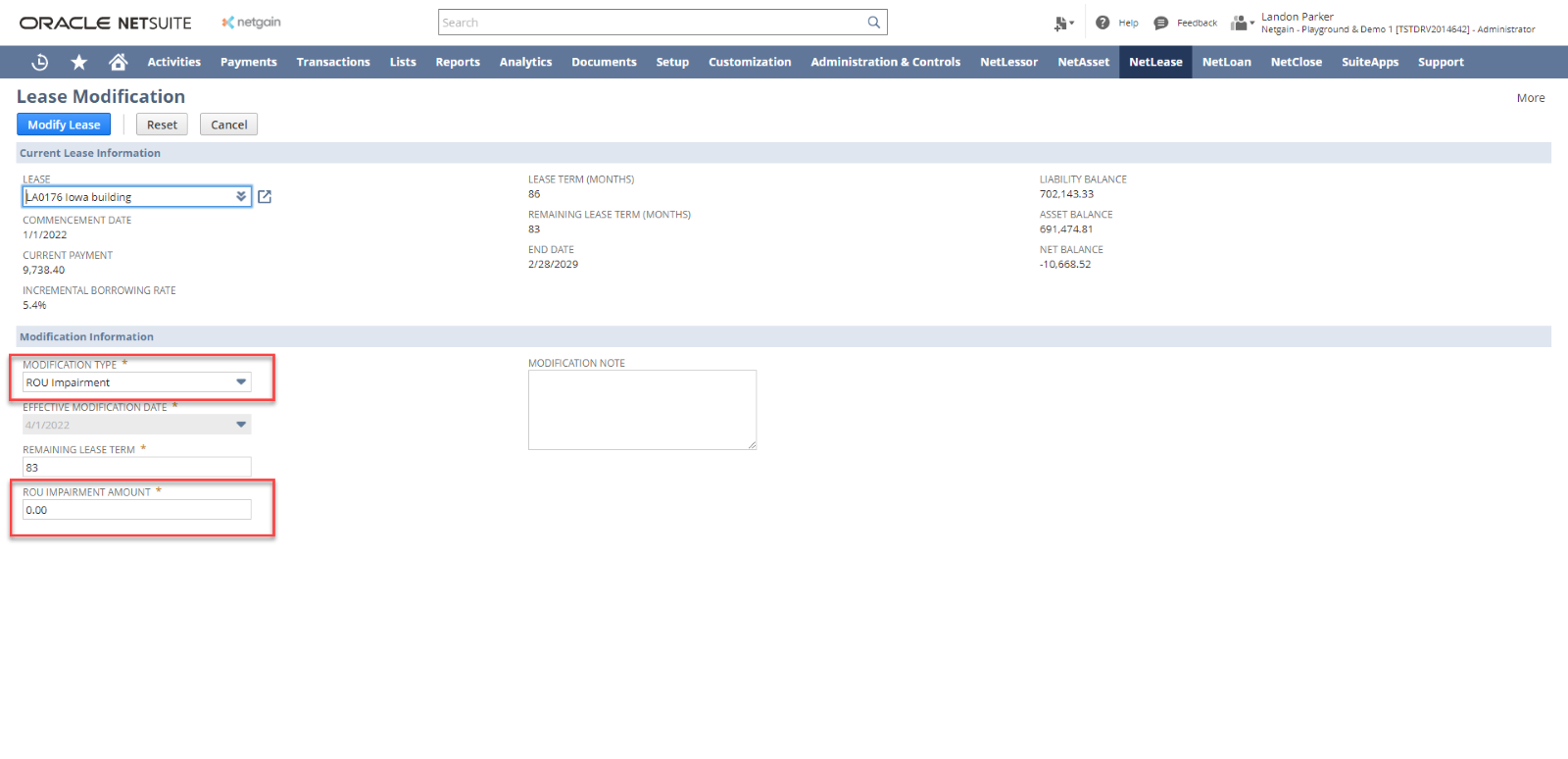

A lessee is subject to the same asset impairment guidance previous to the new lease accounting standards (ASC 360 and IAS 36), which indicate that an impairment is to be recorded when an asset’s carrying amount is not recoverable (US GAAP) or exceeds the higher of the asset’s value in use and fair value less costs to sell (IFRS).

NetLease supports the accounting for impairments, whether for financing leases or operating leases:

- ROU Impairment for financing leases (all IFRS and US GAAP) > Write down the ROU balance and record an impairment charge. The future amortization expense will be revised by calculating a new straight-line amortization based on the revised asset value

- ROU impairment on operating leases (US GAAP only) > Write down the ROU balance and record an impairment charge. The lease expense should no longer be recognized on a straight-line basis but recorded monthly as the sum of (1) straight-line ROU amortization amount, plus (2) the effective interest of the lease liability.

The previous screenshot of the lease modification form within NetLease shows the ROU Impairment type of modification and how to account for the charge of an ROU Impairment certain lease.

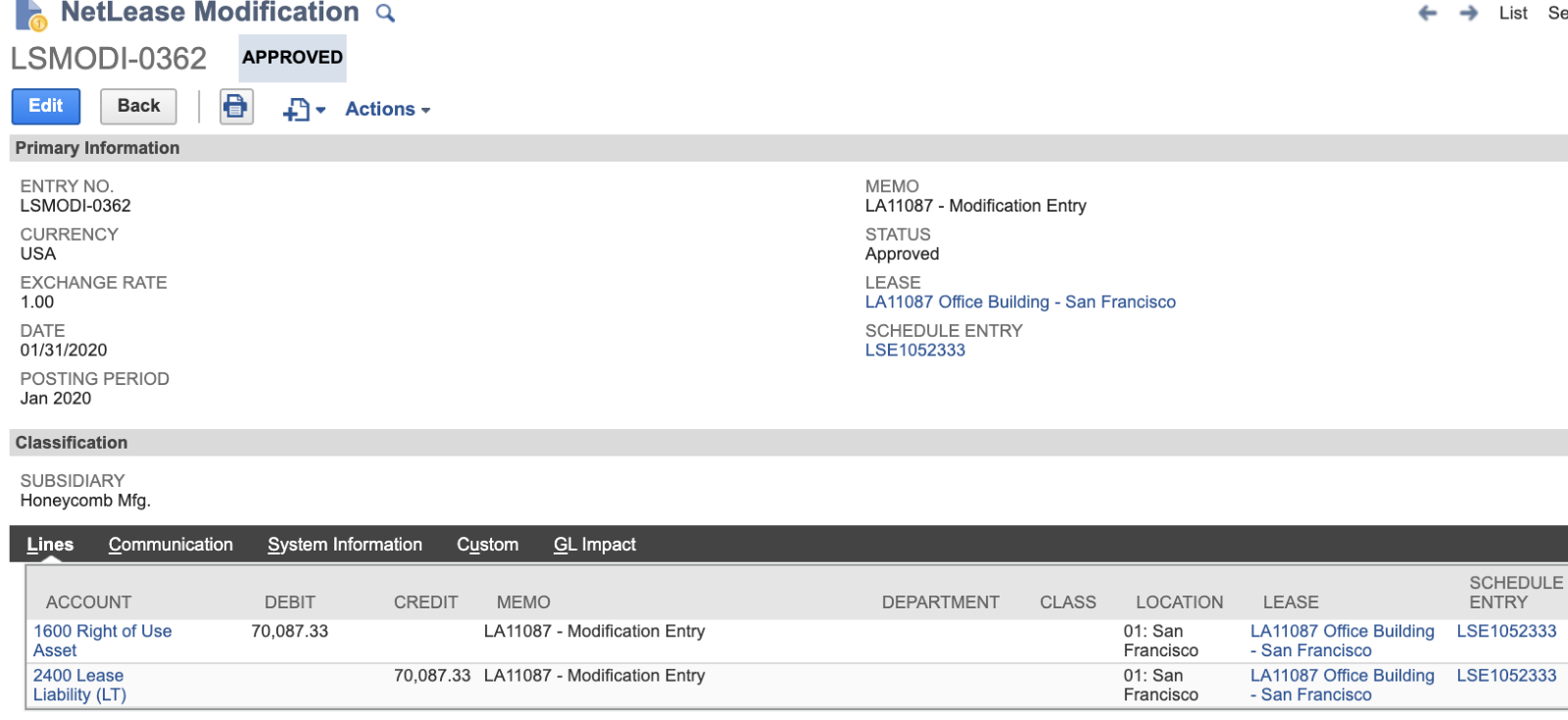

Post-modification amortization schedule

After a modification has been booked within NetLease, the amortization schedule is automatically updated prospectively from the time of the modification. The following screenshots show the journal entry that is associated with the modification, thus updating the ROU asset and lease liability.

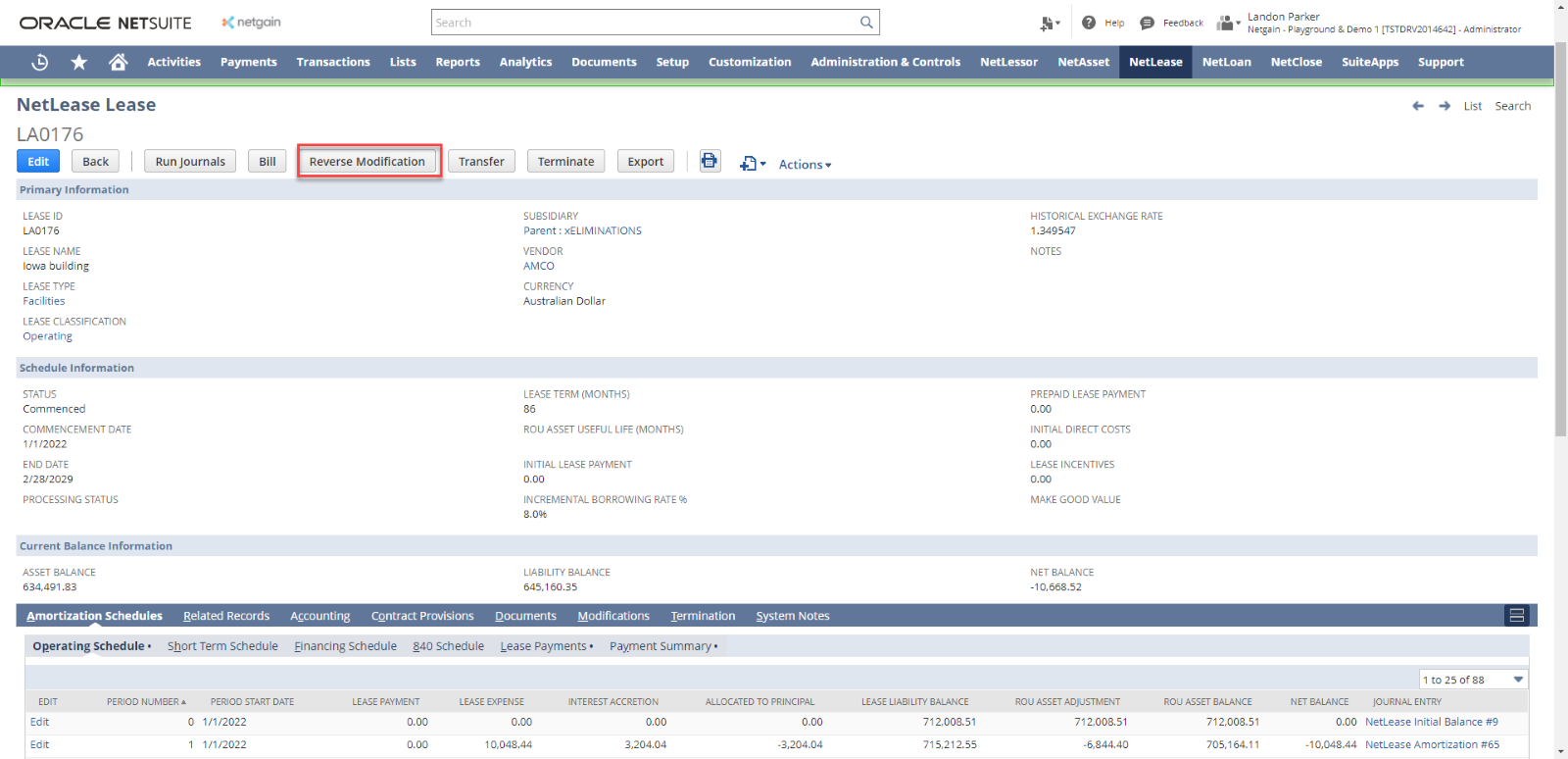

Once a modification has been made, NetLease also allows you to reverse a modification if you have made a mistake in the modification process. The Reverse Modification button appears along the top of the lease.

Bottom line

Modifications under ASC 842 are much more involved than under previous standards. To handle these modifications, I highly recommend using a software solution like NetLease. The recalculation process becomes automated, organized, and consistent, letting you skip the treacherous spreadsheet.