Companies are in the middle of a huge accounting requirement change thanks to ASC 842 for leases. With this new guidance, both operating and financing leases are required to be recognized on the balance sheet, whereas previously only finance leases were present. With this addition to the balance sheet, there are more presentation and disclosure requirements than ever previously required and they require A LOT of work.

Key Takeaways

- Due to ASC 842, both operating and financing leases are required to be recognized on the balance sheet, increasing the quantitative and qualitative disclosure requirements.

- NetLease can ease the transition into ASC 842 by automatically populating quantitative disclosures at the click of a button.

- The types of quantitative disclosure this applies to include lease costs disclosures, maturity analysis disclosures, and weighted averages disclosures, among others.

What Are the New Disclosures Required Under ASC 842?

There are both new qualitative disclosures and quantitative disclosures included in the ASC 842 guidance. In this article, the focus will be on the quantitative disclosure requirements and how NetLease can ease the transition into ASC 842.

The typical process for putting together lease disclosures is time-consuming. It involves gathering all the relevant lease data, which is a big undertaking depending on the number of leases in use. The company then needs to perform the calculations for the required quantitative disclosures.

These calculations include Lease Costs, Maturity Analysis, Weighted Averages, and Other Information. After making these calculations, the company must undergo data validation required by internal controls and its auditors. To add complexity, these disclosures must be regularly updated for lease additions, terminations, and modifications for each reporting period.

How NetLease Can Make Generating Disclosure Reports Easier and More Accurate

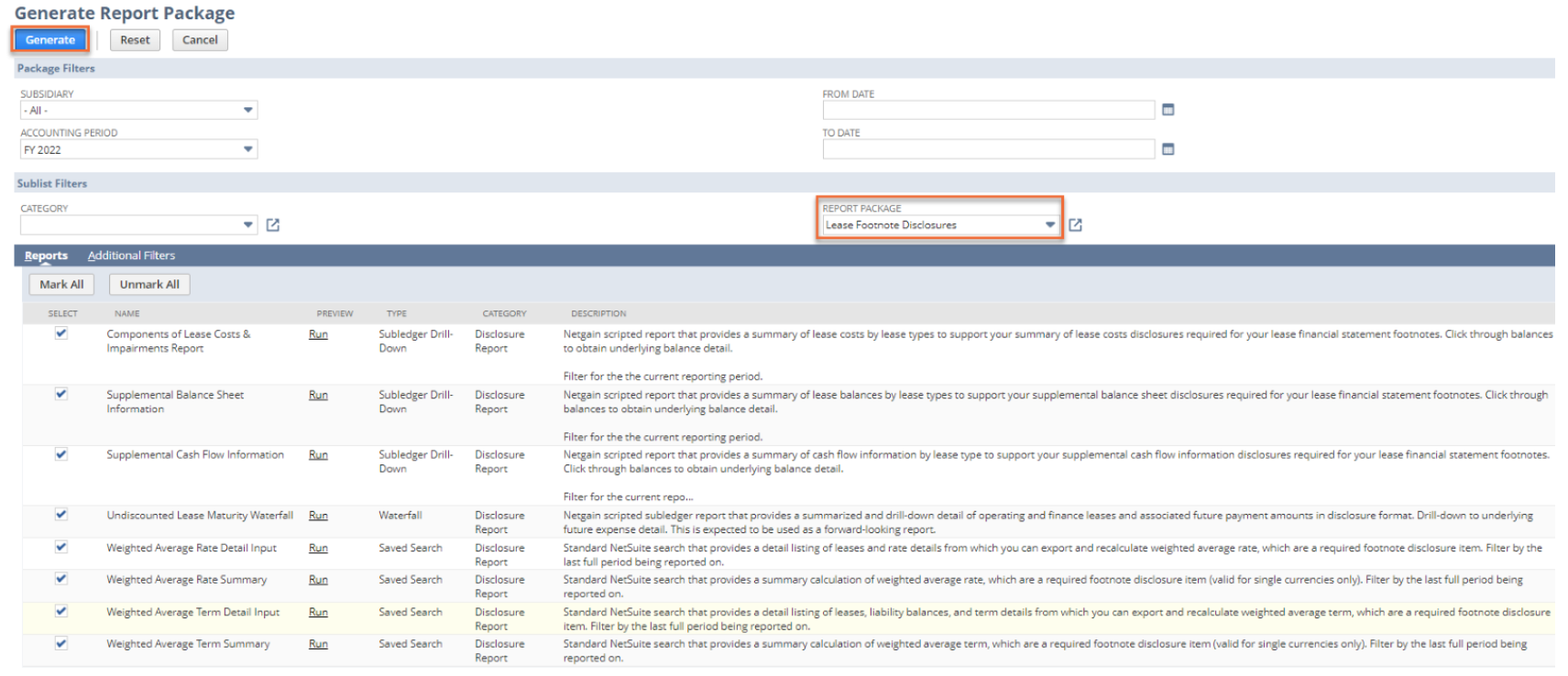

With the help of NetLease’s Reports tool, all the required disclosure reports can be generated with a single button. From there, these reports can be quickly exported to Excel or as a PDF and attached as company footnotes. See screenshot below.

Types of Quantitative Disclosures

Find explanations of each of the types of quantitative lease disclosures below.

Lease Costs Disclosures

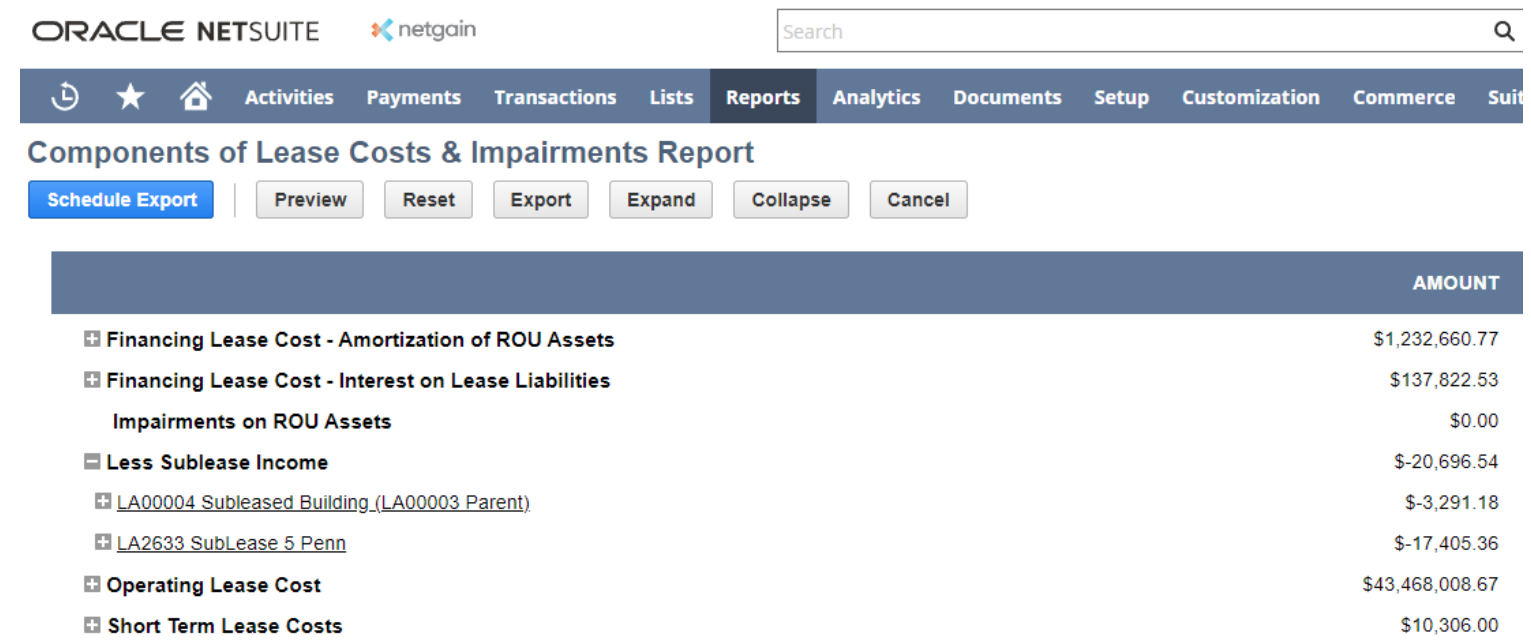

For each period represented in the financial statement, a lessee must disclose the total cost associated with operating and finance leases (ASC 842-20-50-4). The disclosure report must include a separation of short-term lease cost, variable lease cost, sublease income, the net gain/loss on sale and leaseback transactions, as well as a disclosure of the lease expense for entities that have elected the practical expedient. The net of all these will equal the total annual consolidated lease cost.

NetLease provides all this data in the Components of Lease Costs & Impairments Report. A summary of all the company-level information for leases is found here. Additionally, it is easy to expand each calculation to view the individual leases that make up the total. See below.

Maturity Analysis Disclosures

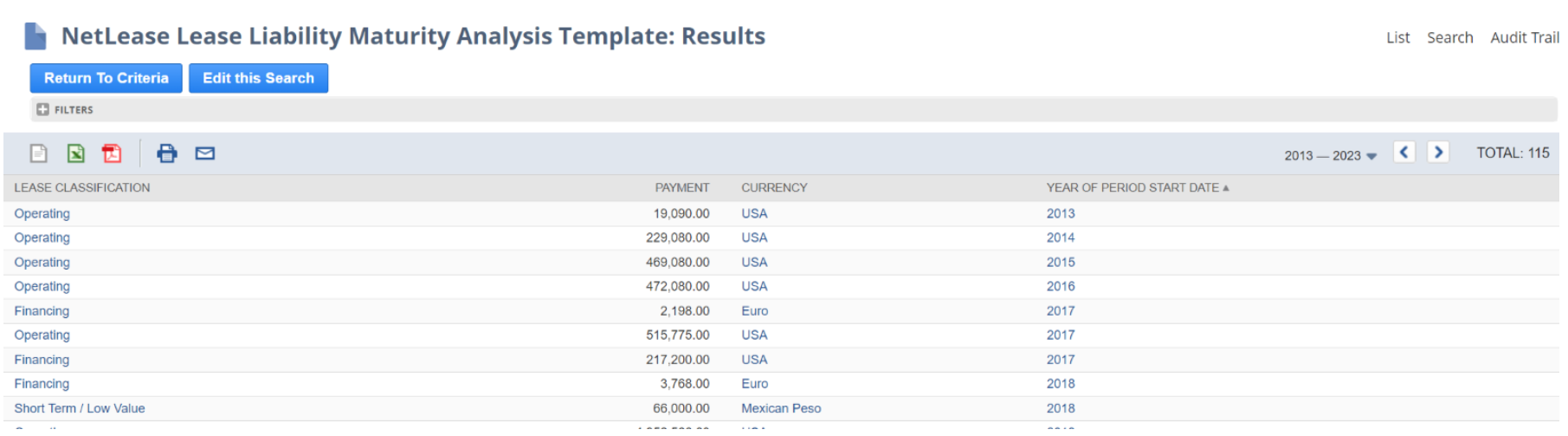

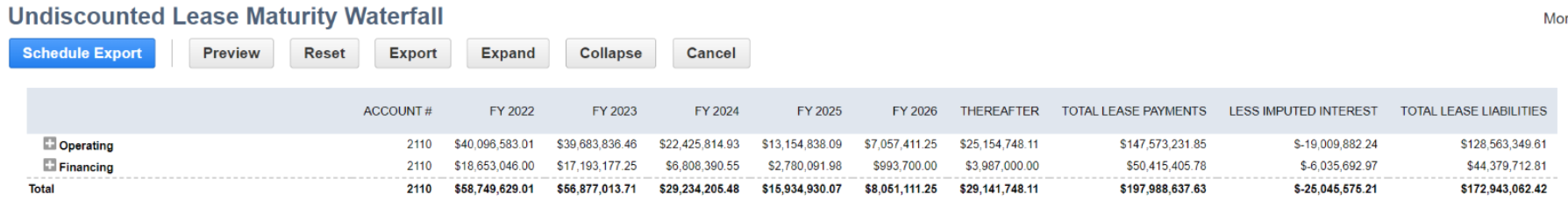

According to ASC 842-20-50-6, the lessee must disclose the maturity analysis for both operating and financing leases separately. This maturity analysis will show the undiscounted annual projection of cash flows covering at least a five-year period and a total of the remaining years.

NetLease summarizes all the maturity information required for this disclosure in the Lease Liability Maturity Analysis Report. This report details all future undiscounted lease payments grouped by lease type and payment year/quarter. Another useful report is the Undiscounted Lease Maturity Waterfall report. This report provides a summarized and drill-down detail of operating and finance leases, and the associated future payment amounts in disclosure format. This report is primarily expected to be used as a forward-looking report. Below are examples of each report.

Weighted Averages Disclosures

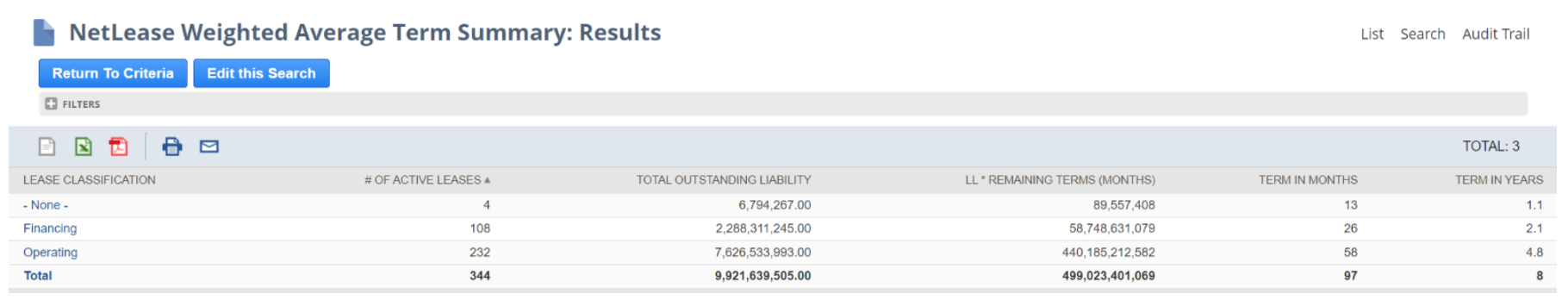

Some of the most complicated quantitative reports required by ASC 842 are the weighted average calculations (ASC 842-20-50-5). This is where most companies will view having a solid software provider as a necessity. There are two required disclosures in this area: the weighted-average remaining lease term and the weighted-average discount rate.

Steps for calculating the weighted-average remaining lease term:

- Gather data for all lease liability balances and the remaining lease term at year-end

- Multiply each lease liability balance by its remaining lease term

- Divide this amount by the sum of the lease liability at year-end

This will give the lessee the weighted-average remaining lease term for their operating and finance leases. Essentially, the remaining lease terms are weighted based on the corresponding lease liabilities. Below is an example of the generated NetLease report.

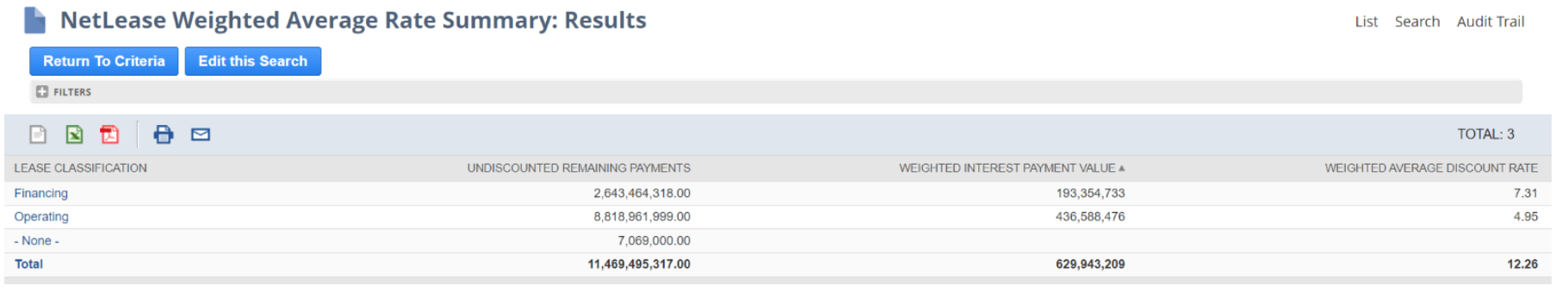

Next, ASC 842 requires the weighted-average discount rate based on the discount rate used to calculate the lease liability balance and the remaining balance of the lease payments. Both operating and finance leases must have separate weighted-average calculated.

Steps for calculating the weighted-average discount rate:

- Each lease must individually be multiplied by the discount rate

- That amount is then divided by the sum of the remaining payments for each type of lease (operating or financing).

This will give the lessee the weighted-average discount rate for each type of lease. Below is an example of the generated NetLease report.

Other Information Disclosures

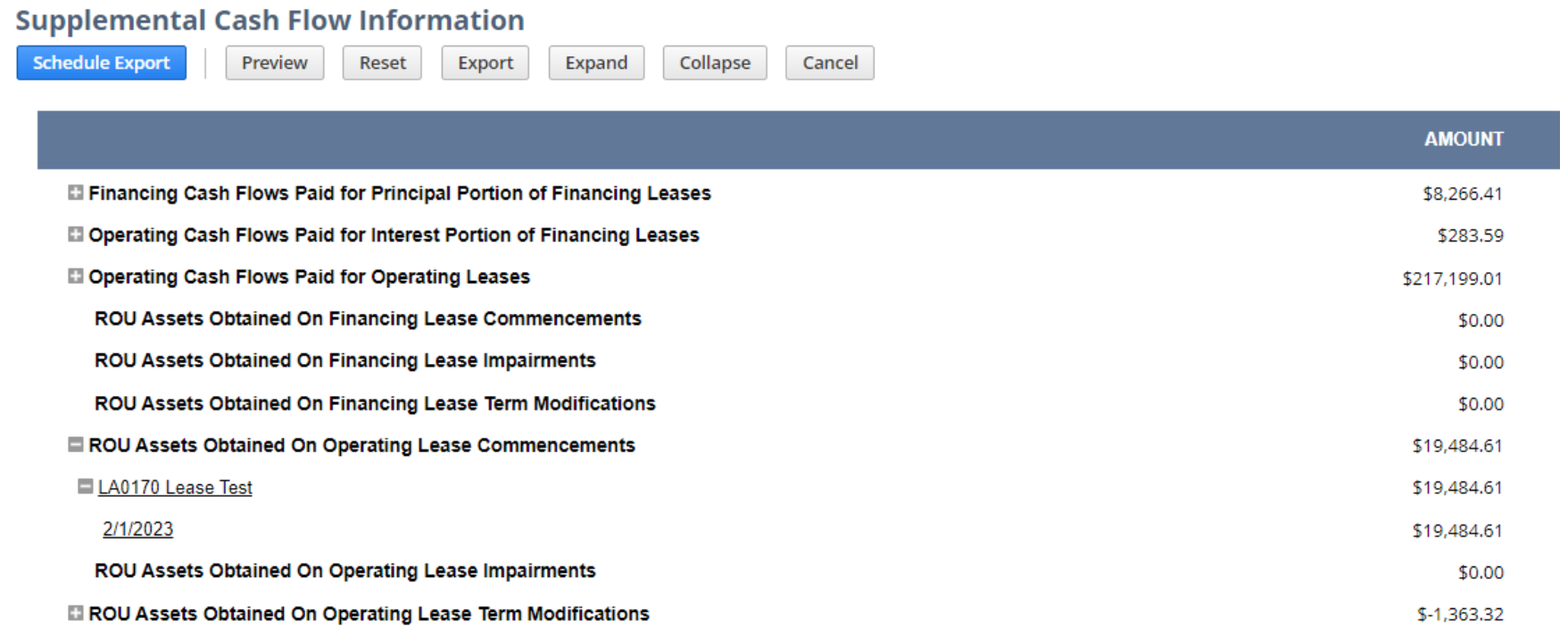

To help investors better understand the cash flows and operations of a business, ASC 842 requires disclosures on cash flow and supplemental non-cash information relating to lease liabilities.

Disclosure of cash paid-for amounts included in the measurement of lease liabilities is required. These amounts should be separated between operating and financing cash flows. This requires that the operating cash flows for both finance and operating leases as well as the financing cash flows for finance leases must be disclosed.

-

Operating Lease Requirements

The operating lease disclosure requires lessees to disclose the difference between the cash the lessee pays for the lease and the actual expense recognized in the financials (i.e. the sum of the liability reduction recognized over a 12-month period).

-

Finance Lease Requirements

Similar to the operating requirement, the finance lease disclosure requires the lessee to disclose the financing cash flows as the sum of the liability reduction booked over a 12-month period. This includes disclosing the financing cash flows from finance leases which includes the lease expense recognized during the reporting period for the finance lease.

-

Supplemental Non-cash Information Requirements

ASC 842 requires the disclosure of supplemental non-cash information regarding finance and operating lease liabilities occurring from a company obtaining a right-of-use (ROU) asset. Non-cash changes are summarized in NetLease’s Supplemental Cash Flow Information Report as seen below. Each summary line can be expanded to see the individual leases making up the totals.

If a company has entered into a sale-and-leaseback transaction, the gain or loss from this transaction must also be calculated by the company and presented in the lease footnote.

Bottom Line

Companies have a lot of changes to make with the adaptation of ASC 842. There are many presentation and disclosure requirements that are completely new. The disclosures alone require significant manpower when taken on an individual level—however, with the help of NetLease by Netgain, the quantitative disclosures can be automatically populated with the click of a button, freeing up hours upon hours to spend on other areas including the qualitative disclosures.

About the Author

Maggie Smith is a Senior Implementation Consultant at Netgain. During her schooling, she worked for a small accounting software company and developed a love for helping ease the lives of accountants with intuitive software. After receiving her Masters of Accounting, she worked for Deloitte specializing in multistate tax for private equity companies. She then took her skills to Eide Bailly where she did work for a variety of small to mid-size companies and high-net-worth individuals. She is now happy to be combining her love of software with client interaction at Netgain on their implementation team.

Maggie Smith is a Senior Implementation Consultant at Netgain. During her schooling, she worked for a small accounting software company and developed a love for helping ease the lives of accountants with intuitive software. After receiving her Masters of Accounting, she worked for Deloitte specializing in multistate tax for private equity companies. She then took her skills to Eide Bailly where she did work for a variety of small to mid-size companies and high-net-worth individuals. She is now happy to be combining her love of software with client interaction at Netgain on their implementation team.