Last updated on March 9, 2023 by Austin Dorman

At Netgain, we focus on generating value through the research, design, development, sale, and implementation of software products that simplify, standardize, and automate complex finance and accounting processes and systems.

One of our hottest products right now is NetAsset, an advanced fixed asset solution built 100% on the NetSuite platform. If your company is managing its fixed assets in Excel or another software solution, NetAsset will provide benefits that will reduce risk, save time, and help increase your bottom line.

NetAsset has an extensive list of features that create value. I am going to discuss three of my favorites: 1) advanced reporting, 2) the CIP capitalization process, and 3) intuitive and flexible user experience.

Key Takeaways:

- NetAsset provides an advanced fixed asset solution built 100% on the NetSuite platform with features such as advanced reporting, a CIP capitalization process, and an intuitive and flexible user experience

- NetAsset's advanced reporting feature generates a fixed asset roll forward report with full drill-down capabilities, data can be summarized by asset class or expanded displaying individual asset detail

- NetAsset's CIP capitalization process allows users to aggregate and capitalize CIP in one easy step, and the intuitive and flexible user experience allows users to customize and configure the product to their specific asset management needs

Advanced Reporting

Having been a Big 4 auditor in my previous life (still recovering), I have seen how many iterations it takes to come up with an accurate fixed asset roll forward. I would go back and forth with my clients multiple times until we finally felt comfortable with their report. On the surface, the fixed asset roll forward does not appear difficult. However, there can be thousands or even hundreds of thousands of moving pieces which make the report very time-consuming and prone to error.

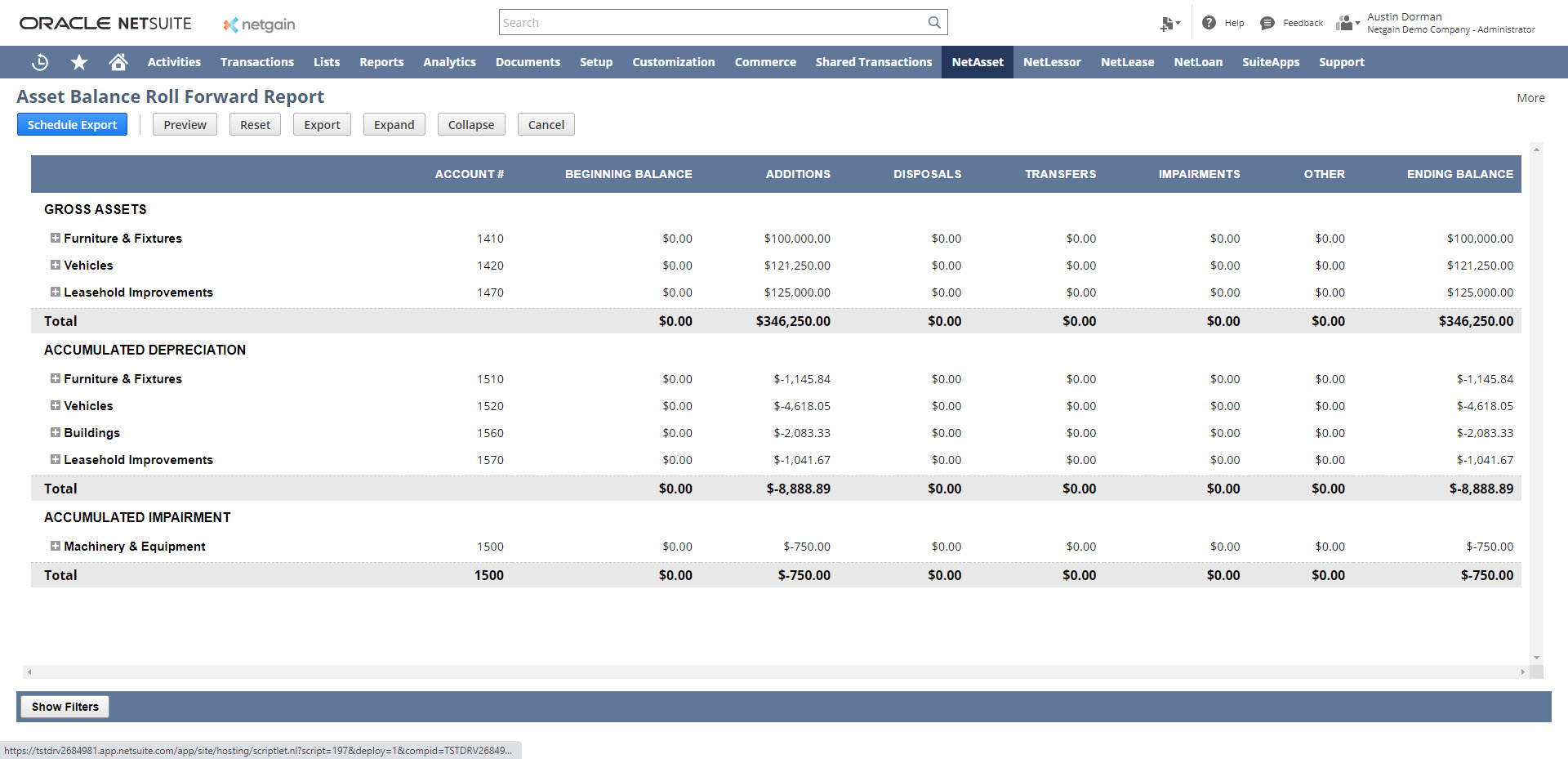

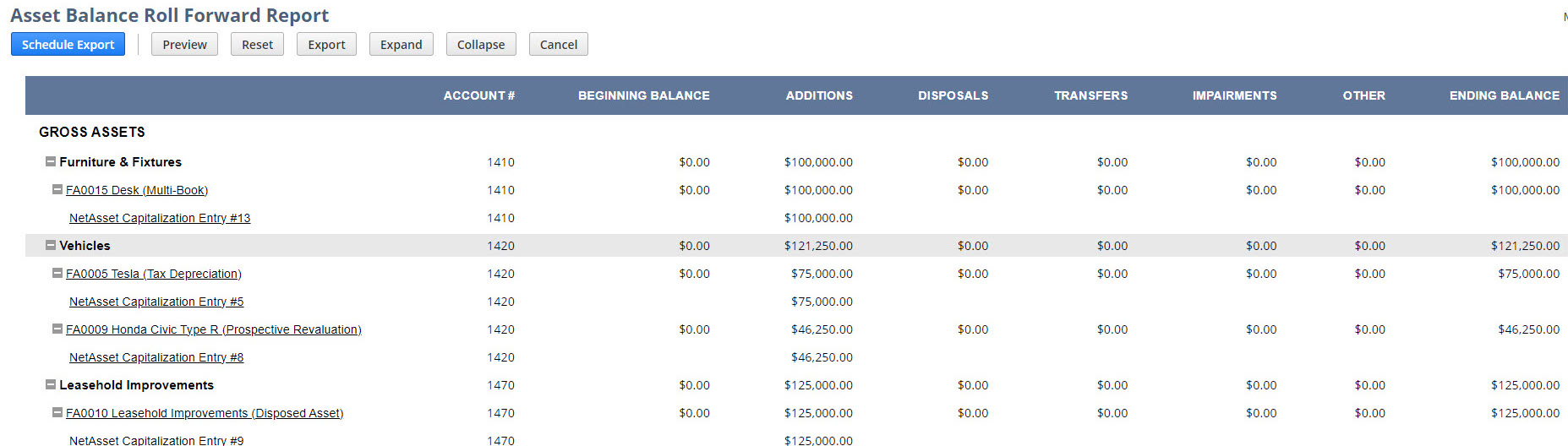

What if you could have your accounting software generate this report for you? That would save a lot of time, right? NetAsset provides an out-of-the-box fixed asset roll forward that is systematically generated so neither you nor your auditors need worry about the accuracy of the report. You can also filter using native NetSuite segments and the period range you would like to see. The report has full drill-down capabilities. Data can be summarized by asset class or expanded displaying individual asset detail which can then be exported to Excel and sent to the auditors.

NetAsset also provides depreciation waterfall reports to help with forecasting, reconciliation reports to help with month end, and financial/subledger reports to help with internal and external reporting. NetAsset was built by accountants who understand the reports that you need.

Please see related screenshots for 1) full asset roll forward and 2) zoomed in on asset type.

Full Asset Roll Forward

Zoomed in on Asset Type

Construction In Progress (CIP) Capitalization Process

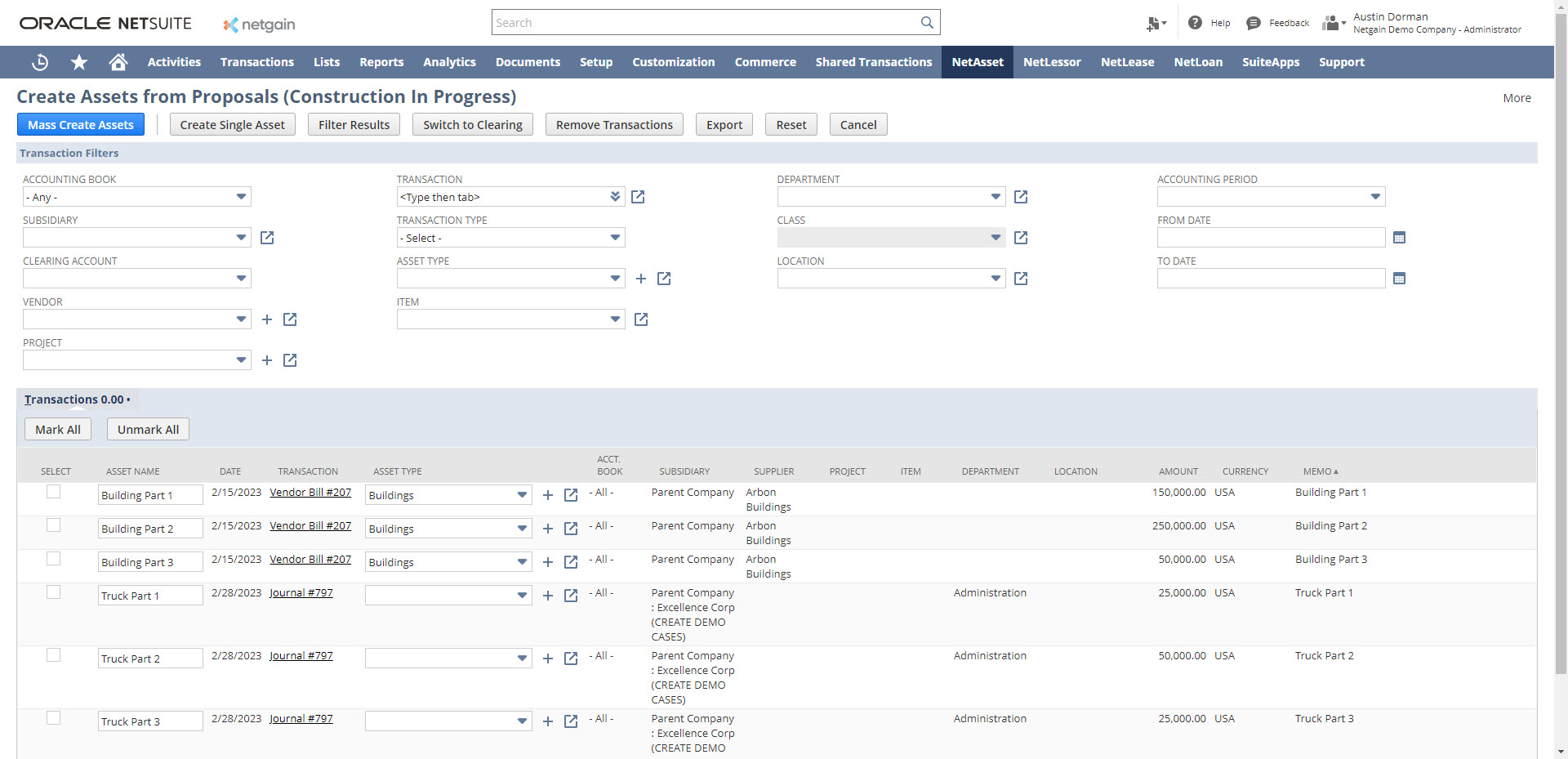

If your company has CIP/WIP and you are on NetSuite, my guess is you have run into challenges. NetAsset provides a platform to aggregate and capitalize CIP in one easy step.

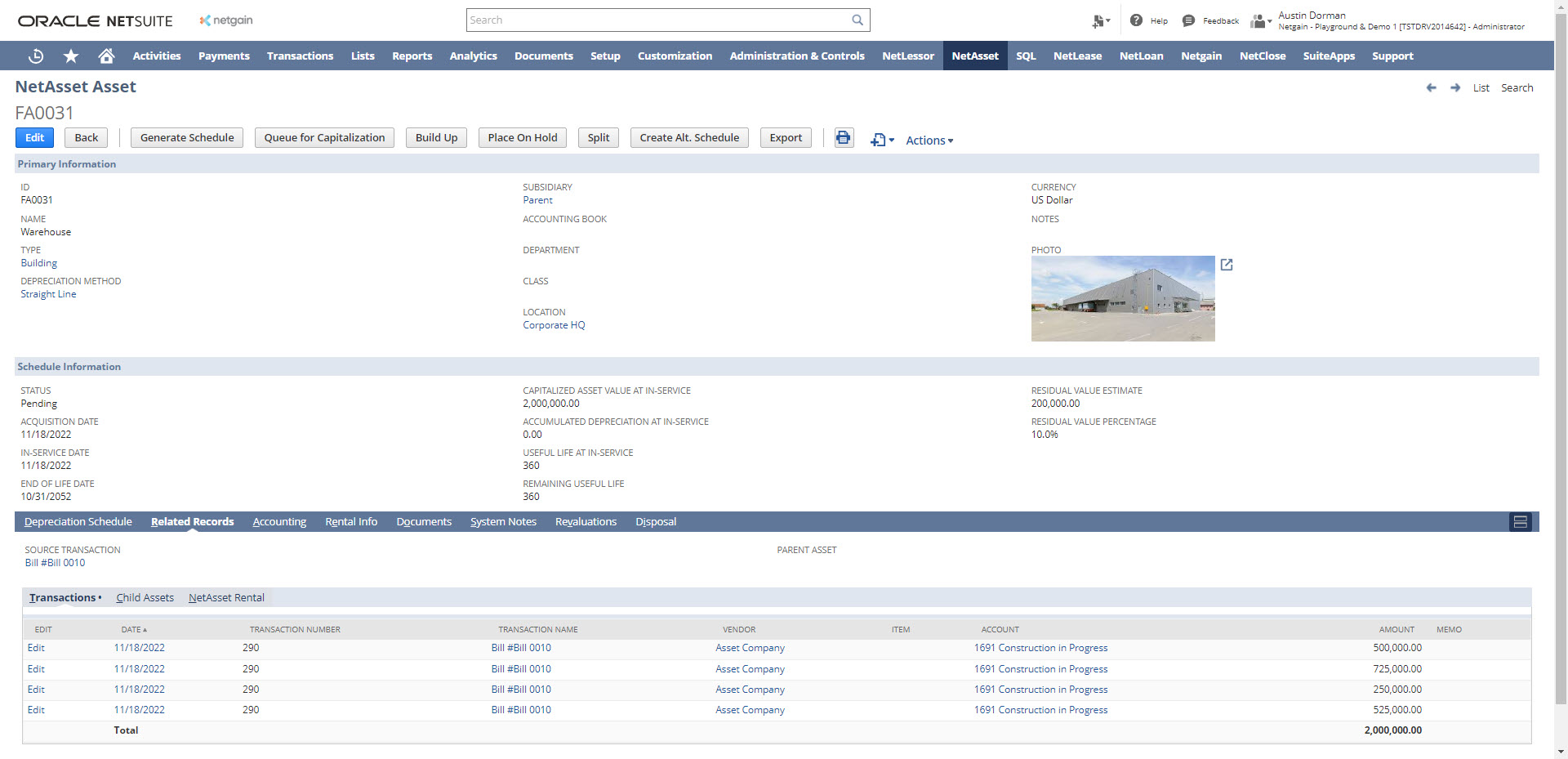

Let’s say your company is building a storage garage. You book 15 invoices for the parts and labor to CIP related to this project. In NetAsset, you can simply filter for this project, select the 15 transactions (vendor bill, journal entries, etc.), then capitalize the asset. The system gives you the option to create 15 separate assets or one single asset. In our example, we are building a garage so we would capitalize into one single asset. Once the asset is capitalized, each of those 15 transactions will be permanently linked to a single asset record. Capitalizing assets from CIP has never been this easy in NetSuite. You are now ready to place the asset in service and start depreciating.

Please see sample screenshots for 1) the NetAsset CIP account interface and 2) related source transaction details on the asset record.

CIP User Interface

Related Transactions On Asset Record

Intuitive and Flexible User Experience

NetAsset is built 100% on the NetSuite platform by developers who know NetSuite as well as anyone. This gives the product a completely native feel, and if you know how to use NetSuite, you will have no problem using NetAsset. From a user’s perspective, the process is intuitive and simple. From robust dashboards, to straightforward asset capitalization, booking journal entries, and reporting, automation allows you to get the job done efficiently without the headache.

NetAsset takes care of your accounting needs as well as asset management needs. We leverage native records and reports which you can customize and configure to your liking. You have specific asset management requirements such as tracking rentable square footage or insurance requirements? No problem, simply add the custom field onto the asset record. You can then add and report on any fields that would help you meet your reporting and asset management needs. This flexibility makes this SuiteApp feel like it is a fixed asset subledger solution designed specifically for you and your business.

Bottom Line

NetAsset is your solution for managing fixed assets. With its intuitive and flexible user experience, you’ll be able to navigate seamlessly around the software — from creating assets with our CIP capitalization process, to accessing our advanced reports including the fixed asset roll forward report. NetAsset will provide benefits that will help you reduce risk, save time, and increase your bottom line.

FAQs

What does roll forward mean in accounting?

Roll forward in accounting is a process of updating the balances of a financial statement or report to reflect the changes that occurred during a subsequent period.

It provides a clear picture of the activity of the fixed assets over time and is also used in the context of audit procedures to verify the accuracy of financial statements by rolling forward prior year balances and transactions to the current year.

What is the purpose of a roll forward in accounting?

The purpose of a roll forward in accounting is to track changes in account balances over time and ensure that all financial transactions are accurately reflected in financial statements. It also identifies discrepancies or errors in financial records and provides a clear and accurate picture of an organization's financial activity over time.

Thus, helping the organization make informed business decisions and make auditors ascertain that financial statements are accurate.

What is the journal entry for fixed assets?

The journal entry for fixed assets is a way to record the purchase and any changes in the value of a fixed asset. For example, the initial purchase of a fixed asset is recorded by debiting the fixed asset account and crediting either the cash or accounts payable account.

Over time, as the asset depreciates or becomes impaired, additional journal entries may be required to adjust the value of the asset. The specific journal entries needed will vary based on each organization's circumstances and accounting practices.

How do you roll forward financial statements?

To roll forward financial statements, you need to update the information from the previous period to the current period. This involves taking the ending balances from the previous period and carrying them forward as the beginning balances for the current period.

To do this, you will need to gather financial data from various sources, such as general ledger accounts, subsidiary ledgers, bank statements, and other financial documents.

Then, enter the data into the accounting system and generate updated financial statements. This process should be done regularly such as monthly or quarterly to provide management with current and relevant financial information.

What is an example of a roll forward?

An example of a roll forward is a balance sheet roll forward which shows the changes in the balance sheet accounts from one period to the next. For example, you have a balance sheet as of December 31, 2021. You want to create a roll forward for the accounts receivable balance on January 31, 2022.

You would take the accounts receivable balance as of December 31, 2021, and add any new sales invoices created in January 2022. You would then subtract any payments received in January 2022 from customers for outstanding invoices as of December 31, 2021. The resulting total would be the accounts receivable balance as of January 31, 2022.

What is an asset roll forward report?

An asset roll forward report is a financial statement that shows the changes in an asset account over a specific period of time. The report provides a detailed record of the asset's opening balance, additions, disposals, and closing balance for a particular period, typically a month, quarter, or year.

What is the difference between Rollback and Roll Forward?

Rollback and roll forward are two accounting concepts that are used to make adjustments to financial statements. Rollback is the process of reversing a transaction that has already been recorded in the financial statements, typically to correct an error.

On the other hand, roll forward is the process of taking a previously recorded balance and projecting it forward to a new point in time, usually the end of the current period.

What does 12 months rolling mean?

The term "12 months rolling" refers to a method of tracking and analyzing data over a period of time that moves forward by 12 months at the end of each month.

This means that at any given point in time, the data being analyzed includes the most recent 12-month period. As time passes, the oldest month's data is dropped and replaced with data from the current month.

About the Authors

Austin Dorman is a Senior Consultant at Netgain. After receiving a Master of Accountancy and a Minor in Information Systems, he began his career at Deloitte in their Business Tax Services division doing tax compliance and reporting for public and private companies. He is excited to be a part of Netgain and the opportunity to help companies automate their accounting!

Austin Dorman is a Senior Consultant at Netgain. After receiving a Master of Accountancy and a Minor in Information Systems, he began his career at Deloitte in their Business Tax Services division doing tax compliance and reporting for public and private companies. He is excited to be a part of Netgain and the opportunity to help companies automate their accounting!

-png.png?width=311&height=311&name=Zack%20Larsen%20(940%20%C3%97%20940%20px)-png.png) Zack Larsen, CPA, is the VP of Sales at Netgain. After receiving a Masters of Accounting, he began his career at Deloitte and later PWC auditing both public and private companies. Zack joined the Netgain team as a Senior Consultant helping clients transition to ASC 842 and streamline other accounting processes. He subsequently worked as a solution consultant on the technical sales side of the business before running the partnership and sales organizations.

Zack Larsen, CPA, is the VP of Sales at Netgain. After receiving a Masters of Accounting, he began his career at Deloitte and later PWC auditing both public and private companies. Zack joined the Netgain team as a Senior Consultant helping clients transition to ASC 842 and streamline other accounting processes. He subsequently worked as a solution consultant on the technical sales side of the business before running the partnership and sales organizations.

.png)