Like many of you, I never thought I would be working with leases daily! Before long, I found myself jumping head-first into a company leading the charge to help accountants understand lease accounting and find useful tools that will save them a tremendous amount of time and headache.

I soon realized that finding clear information on the changes to capital/finance leases under ASC 842 can be daunting and take a lot of time. I would certainly prefer not having to dig around the codification for an hour or two, to gather only bits and pieces of how this change really impacts me and my work.

This article saves you time when searching for recent changes to capital/financing leases and gives you a pleasant overview of how you will need to transition over to the new standard. You’ll even get a fancy excel tool showing these changes, so don’t forget to check that out below.

The old terminology no longer does it

Even though there were only very few changes made in regard to capital/finance leases, one of the most noticeable ASC 842 changes is the new terminology. What was formerly known as a Capital Lease is now known as a Financing Lease under ASC 842. This change was made because, under the new guidelines, all leases will be capitalized to the balance sheet, and the descriptive term “capital” no longer holds any value.

Along with the name change, the account holding the capitalized value of the leased asset changed as well. The Right-of-Use (ROU) asset account will now replace the long-used Capital Fixed-Asset account.

What distinguishes financing leases

As a brief overview, these are leases where a lessor transfers the rights to an asset over to a lessee for a long duration of time in exchange for periodic payments. Typical characteristics of a financing lease are that the lessee usually has possession of the asset for most of its useful life, in addition to a purchase option at the end of the lease term.

The above-mentioned are only two of the often-seen traits of finance leases with a full list of criteria outlined below. Note that only the five criteria below are new to ASC 842 designating special-purpose assets as financing leases because these are specific to the lessee’s use case and will most likely have no further use once the lease term ends.

ASC 842 criteria

- Did the title or ownership transfer over to the lessee once the lease term ended?

- Was there a bargain purchase option?

- Was the lease term equal or higher than 75% of the remaining useful life of the asset?

- Did the sum of lease payments exceed 90% of the fair value of the asset in question?

- Is the leased asset so specialized that there is no alternative use following the lease term?

The transition put simply

Let’s get to the fun part and run through what your transition from ASC 840 to ASC 842 for capital/finance leases will look like. Here is a step-by-step guide of what entries you will need to book.

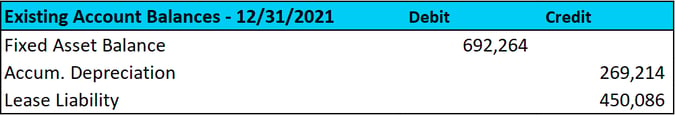

- First, determine the existing fixed asset, accum. depreciation and lease-liability balances on the company's balance sheet as of 12/31/2021.

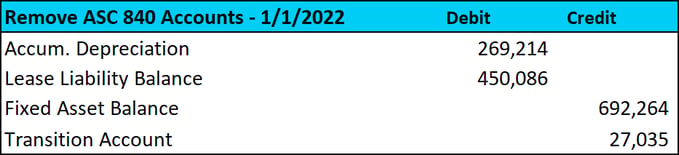

- Next, remove the company's fixed assets, accum. depreciation and lease-liability balances from the balance sheet as of 1/1/2022 by making the following entry.

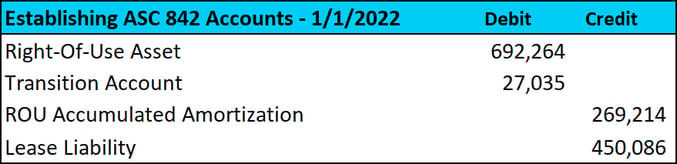

- Lastly, establish lease liability, accum. depreciation and right-of-use asset balance as of 1/1/2022.

The above entries are a small example of the full spreadsheet, which you can download via the link below. It can show you a more in-depth and detailed visualization of this transition based on your own lease balances/inputs with additional information that might prove useful.

Bottom line:

Where very few things have changed for capital/finance leases from ASC 840 to ASC 842, it will still be important to understand those small changes that have been made. You might need to reevaluate whether any of your leases may now be categorized as finance leases due to their specialized nature, but this should be very straightforward to assess.

New terminology has been introduced with little impact on the actual accounting. You will notice that you will in essence only need to move your asset balances to the new account and that the overall balance sheet was not impacted by the transition. The transition for financing leases is much simpler than that of operating leases, so consider yourself lucky if they make up the majority of the leases you currently hold.

Related information

Want to learn more about finance leases?

- Download the workbook to see the accounting firsthand

- Learn more about how to account for finance leases

- Here is similar information for operating leases

- See our FAQ series on the differences between operating and finance leases